A range of countries offers shipping companies the opportunity to be taxed in accordance with tonnage tax regulations, which means paying a fixed amount of tax per ton of tonnage deployed.

The Danish research and analysis company Sea-Intelligence explains that in this case, the pre-tax income does not matter. “If you lose money, you still have to pay tax, but if you are suddenly extremely profitable, like with the carriers in 2021, you get a competitive edge versus the carriers that cannot avail themselves of such tonnage tax,” explained Alan Murphy, CEO of Sea-Intelligence

The Danish analysts have used the shipping lines Maersk, Hapag-Lloyd, CMA CGM, ZIM, and Matson that have published their full-year 2021 financial results, as exampleas.

The three of them, Maersk, Hapag-Lloyd, and CMA CGM fall under the tonnage tax rules, and have a tax rate of 0.7%-3.7%, whereas ZIM and Matson do not, and have a higher 18%-21% tax rate.

Looking at the three larger carriers against the average tax rate paid per TEU across these three carriers, Sea-Intelligence found that Maersk had a tax disadvantage of US$10.3/TEU, CMA CGM was mainly neutral, and Hapag-Lloyd had a tax advantage of US$10.7/TEU.

This translates into a tax disadvantage of US$269 million for Maersk, a US$10 million disadvantage for CMA CGM, and a US$127 million advantage for Hapag-Lloyd, according to the Danish firm’s data.

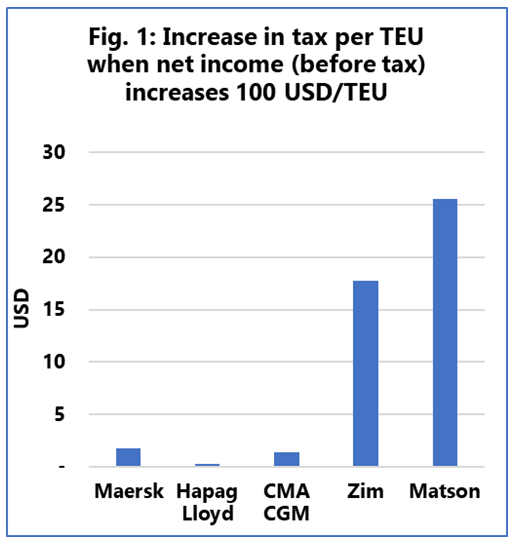

The following figure indicates how much additional tax per TEU the carriers have to pay when the pre-tax income increases US$100 per TEU.

Murphy noted that it is interesting to see the difference between the two carriers who do not have a tonnage tax compared to the larger carriers, in terms of a tax relative competitive advantage/disadvantage.

ZIM paid a price of US$953 million and Matson a price of US$229 million in 2021, compared to a situation where their taxation per TEU had been the same as for the big three tonnage-taxed carriers.

For the big three box lines, every time the pre-tax profit increases by US$100/TEU, the taxation increases US$0.30-1.80/TEU. However, for ZIM and Matson, the increase in taxation as the pre-tax profit goes up by US$100/TEU is US$18 and US$26/TEU, respectively.