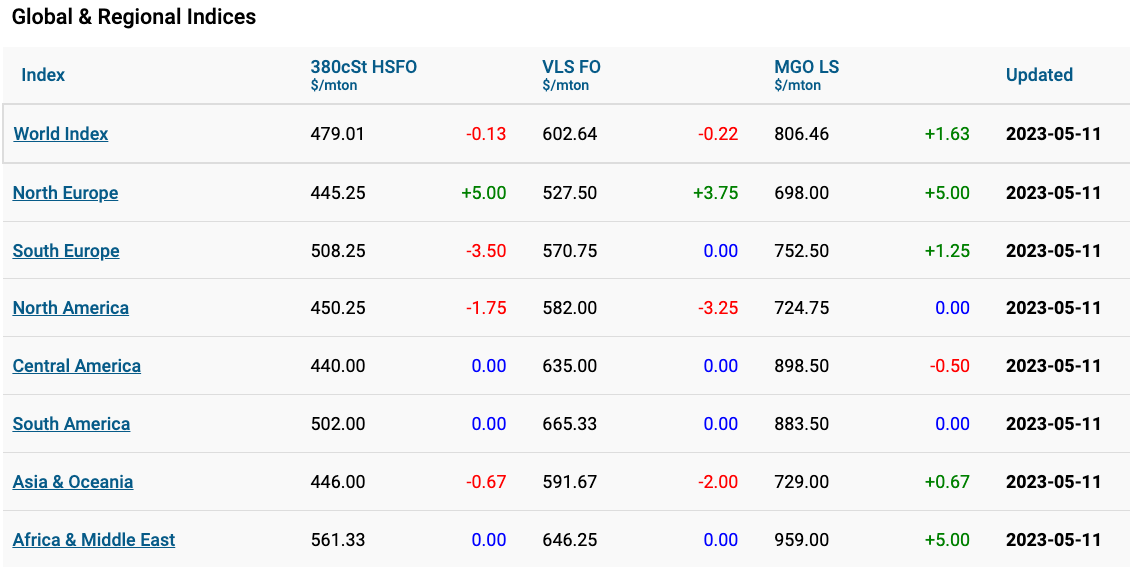

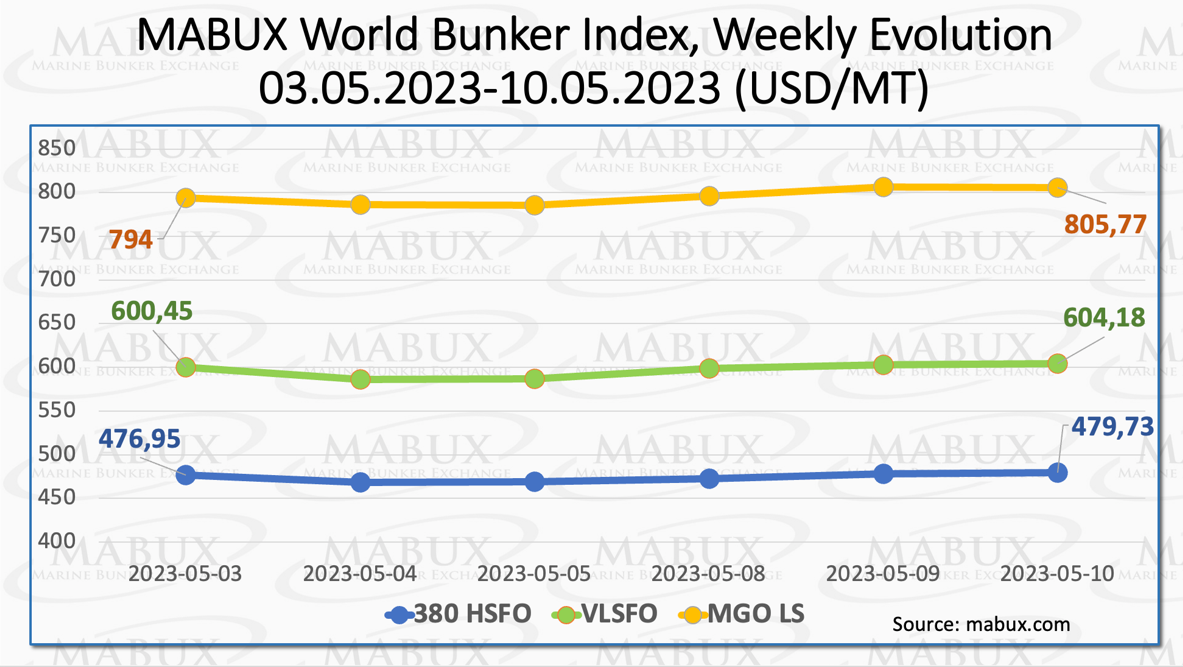

The global Marine Bunker Exchange (MABUX) indices showed a moderate upward trend with the 380 HSFO index increasing to US$479.73/MT, the VLSFO index rising to US$604.18/MT and the MGO index growing to US$805.77.

“As of the time of writing, the market did not exhibit a firm trend,” commented a MABUX representative.

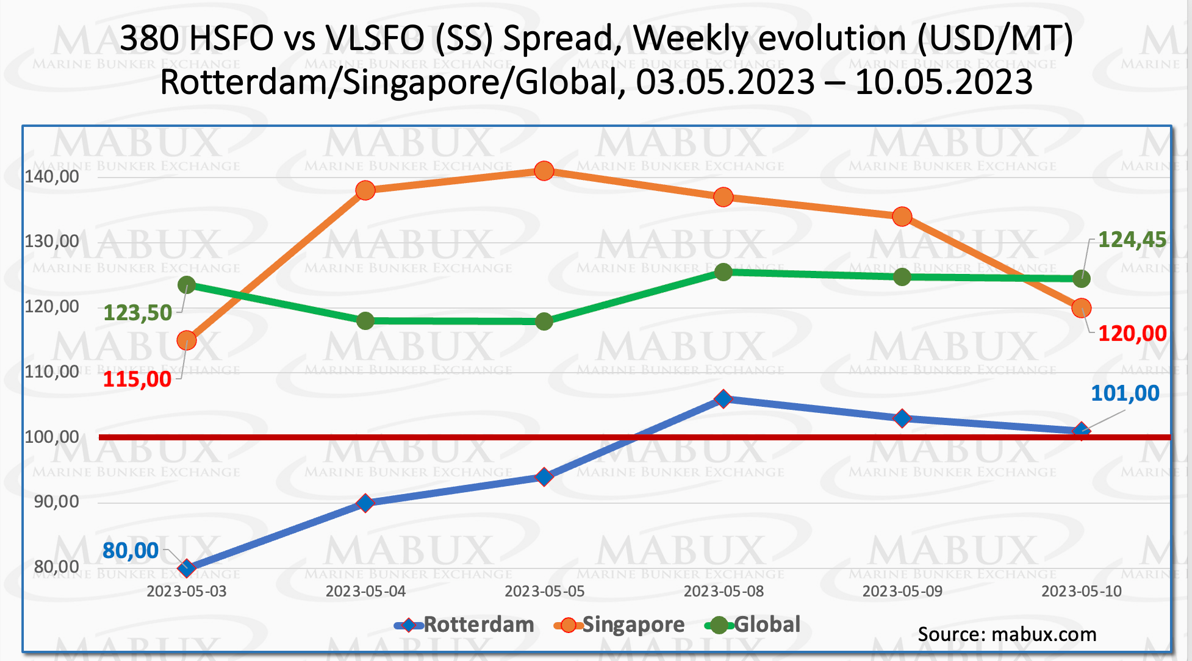

During Week 19, the Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – remained relatively stable, with a minor increase of US$0.95 to US$124.45.

However, the weekly average SS Spread decreased by US$1.46. In Rotterdam, the SS Spread saw a rise of US$21, while the weekly average of SS Spread in Rotterdam also increased by US$6.

In Singapore, the 380 HSFO/VLSFO price difference added US$5 over the week, and the average weekly value increased by US$11.66.

“Overall, signs of some upward correction were observed this week, marking the first time in the last seven weeks,” noted a MABUX official.

Europe’s benchmark natural gas prices extended losses this week – a sixth week of declines amid comfortable inventories and tepid gas demand in Europe and Asia.

Spot LNG prices for delivery into north Asia in June have also slumped – to the lowest level in two years, as demand for the refilling of inventories in top buyers China, Japan, and South Korea remains weak.

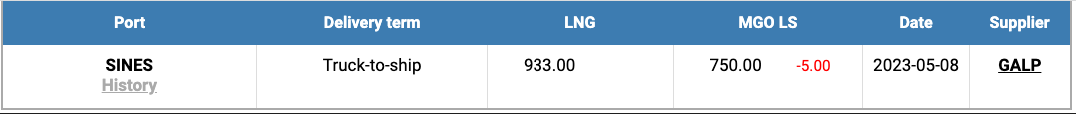

The price of LNG as bunker fuel in the port of Sines (Portugal) decreased again on 8 May, reaching US$933/MT.

The price difference between LNG and conventional fuel also decreased to US$183 on 8 May. MGO LS in the port of Sines was quoted at US$750/MT that day.

As a MABUX official stated, the market continues to register a gradual reduction in the difference in prices between LNG and conventional fuel.

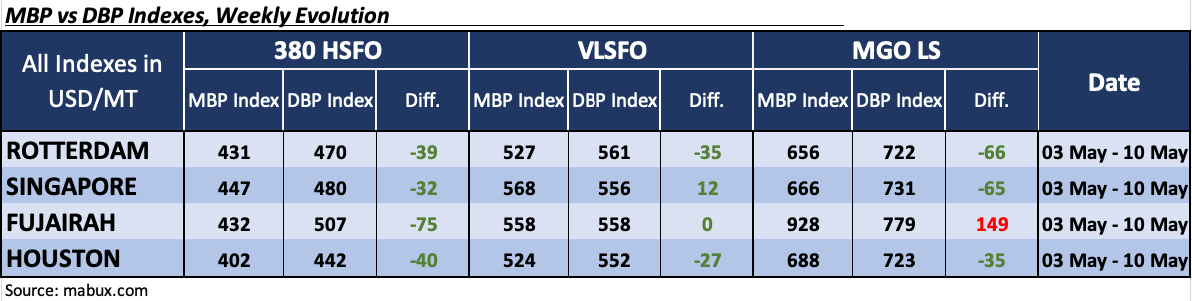

In Week 19, the MDI index (the ratio of market bunker prices (MABUX MBP Index) and the MABUX digital bunker benchmark (MABUX DBP Index)) indicated that 380 HSFO fuel continued to be undervalued in all four selected ports.

The average weekly underprice levels showed moderate declines in all ports, ranging from minus US$4 to minus US$11, except for Houston, where the MDI increased by 10 points.

Similarly, in the VLSFO segment, the fuel continued to be undervalued in all selected ports, with slight declines in undervaluation margins in Rotterdam and Houston by US$14 and US$3, respectively.

However, in Singapore, the MDI rose by US$12, while in Fujairah, there was a 100% correlation between the market price and the digital benchmark, indicating that the fuel was neither undervalued nor overvalued.

Regarding the MGO LS segment, three ports – Rotterdam, Singapore, and Houston – still showed underestimation. The average weekly of undercharge for all three ports remained almost unchanged. Fujairah is still the only overvalued port – plus US$149.

“Multidirectional dynamics continue to prevail in the global bunker market, and we

anticipate that there will be no a sustainable trend in bunker indices in the coming week,”

commented Sergey Ivanov, director of MABUX.