Sea-Intelligence has conducted a report to examine the influx of small vessels on the Transpacific trade, showing that on Asia-North America West Coast (NAWC), there was a decrease from a pre-Covid baseline of 6,000-6,500 TEU to just under 4,500 TEU in 2022.

The classification that was based on the average between the pre-pandemic baseline and the current status of the 25% quartile, also showed that the Asia-North America East Coast (NAEC) trade follows the same trend, with the figure dropping from a 2020 baseline of 7,500-8,000 TEU to over 6,000 TEU in 2022.

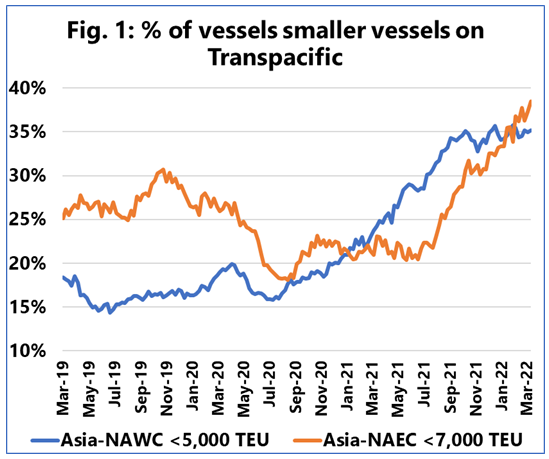

To see if this decrease was a result of an influx of smaller vessels relative to the number of services and not simply a case of there being more services in 2022 than there were in 2019, Sea-Intelligence analysts calculated percentages.

For Asia-NAWC, Sea-Intelligence calculated the percentage of weekly departures that were under 5,000 TEU, whereas for Asia-NAEC, that figure was for vessels under 7,000 TEU. This classification was based on the average between the pre-pandemic baseline and the current status of the 25% quartile, which is shown in the figure above.

On Asia-NAWC, nearly 35% of all weekly departures are under 5,000 TEU, a staggering increase from a pre-pandemic baseline of 15%-20%, according to the analysts, while on Asia-NAEC, this figure is at nearly 40%, a substantial increase from the 20%-25% level in the first half of 2021.

On Asia-Europe, however, there is nothing even close to it as the 25% quartile vessel-size on Asia-North Europe is within normal seasonality, while on Asia-Mediterranean, the 25% quartile vessel-size is largely unchanged from 2019, according to the report.

“We know that niche carriers did launch services on Asia-Europe, but they were seasonal in nature and hardly had an impact, whereas, on the Transpacific, we see a systemic influx of smaller vessels,” noted Alan Murphy, CEO of Sea-Intelligence.

“This also shows that even though both trades are often viewed through the same lens, there are fundamental differences between the two, especially in today’s pandemic-impacted market,” explained Murphy.