The following infographic analyses the breakdown of vessels on order in South Korea, the top ordering nations, the key companies investing in South Korean newbuildings, the most valuable vessels on order and the share of dual fuel vessels being built.

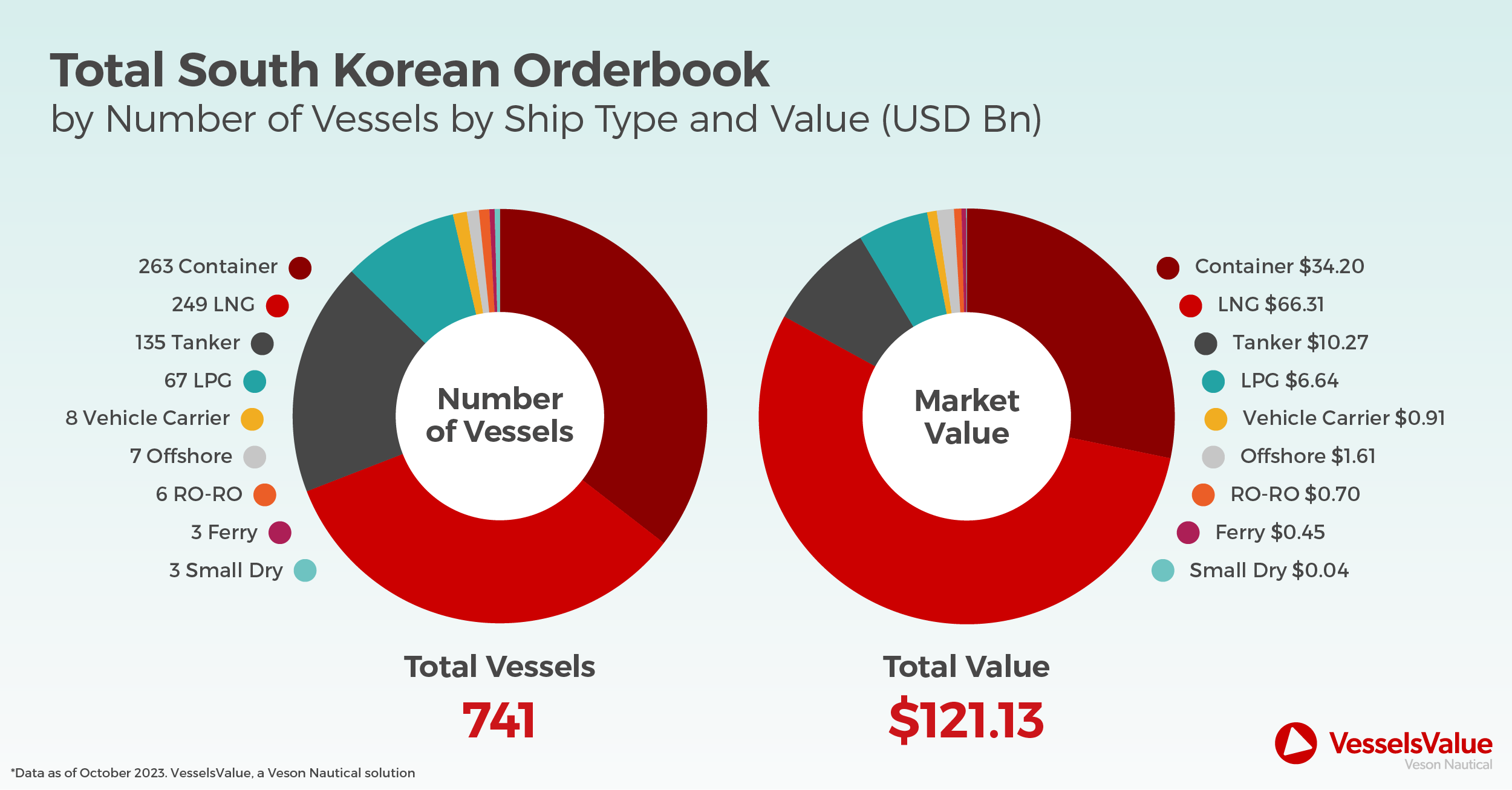

South Korean Orderbook by Vessel Type

Containers are the most popular vessel on order in South Korea, with a total of 263 vessels, followed by LNG carriers with 249 vessels, Tankers ranked third with a total of 135 and LPG carriers are in fourth place with 67 vessels.

LNG carriers are the most valuable sector on order, worth US$34.2 billion. This sector has seen extraordinary increases in values over the last two years with values exceeding record highs at the end of Q3 2022 and continuing to rise since then. The contract price of a newbuild Large LNG vessel of 174,000 CBM, has risen by c. 26.37% since October 2021 from US$203.83 million to US$257.74 million.

Since October 2021, there have been 285 LNG vessel orders globally, which equates to 27.4% of the live fleet. This is due to improved demand fundamentals that have resulted from the ongoing conflict between Ukraine and Russia. Despite a relatively small live fleet of 1,039 vessels, soaring global demand for LNG has sent the values sky high with the fleet value for LNG carriers currently at US$190 billion.

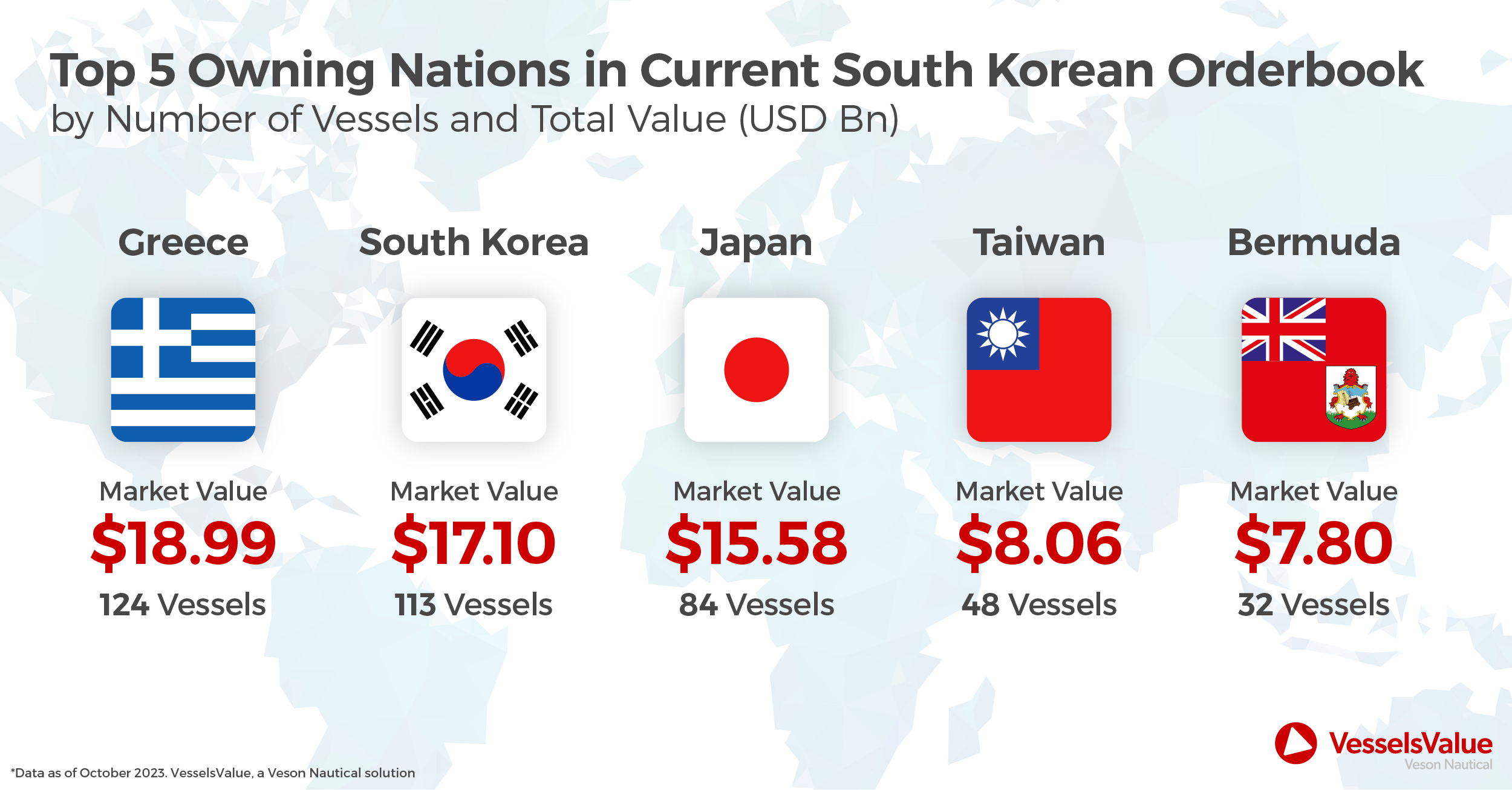

South Korean Orderbook by Top Owning Nations

Of the top-owning nations within the South Korean orderbook. Greece ranks first. This is both by a number of vessels and total value, comprising 124 vessels on order and a total value of US$18.99 billion.

Sea Traders have the largest order book in terms of volume, with 22 Panamax Bulkers on order, followed by Evalend Shipping with 21 vessels on order including VLGC LPGs, Handy Bulkers, Suezmax and LR1 Tankers and Large LNG vessels. Dynacom Tankers have 19 vessels on order ranging from VLCCs to LR2s.

South Korea ranks second with 113 vessels on order and a market value of US$17.1 billion. Japan is in third place with 84 vessels on order, worth US$15.58 billion.

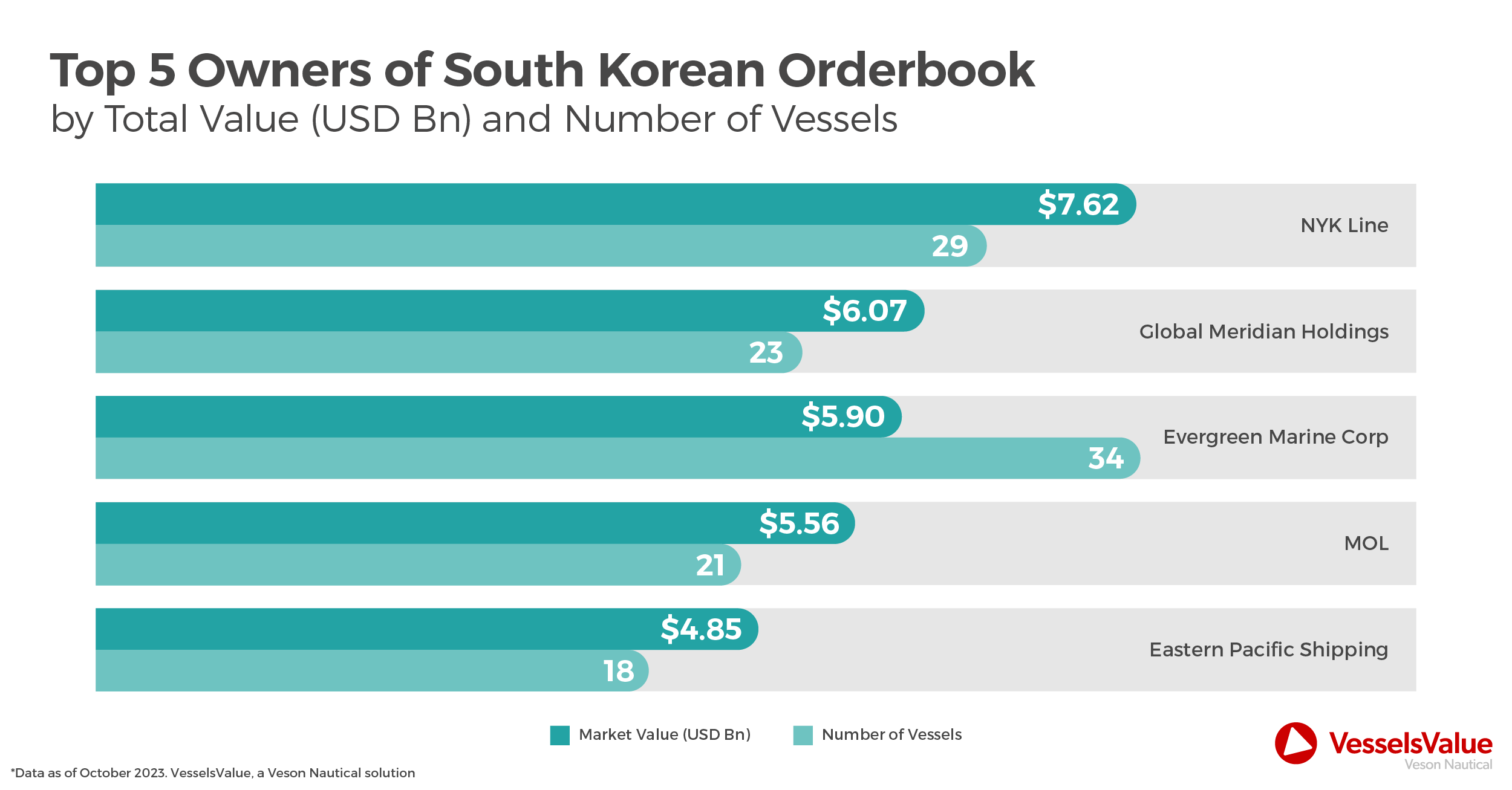

South Korean Orderbook by Top Five Owners

NYK Line is ranked first within a list of the top five owners with vessels on order in South Korea, with an orderbook value of US$7.62 billion, consisting of 29 Large LNG vessels of 174,000 CBM. In addition to the vessels on order in South Korea, NYK Line has a further 32 vessels on order in Japanese and Chinese yards, this includes additional LNG vessel orders, Bulkers, Containers, LPG and Vehicle Carriers. Global Meridian Holdings are in second place with a total of US$6.07 billion on order and a total of 23 vessels, all are Large LNG vessels of 174,000 CMB. With a total orderbook value of US$5.9 billion, Evergreen Marine Corp ranks third.

The 34 vessels on order are all New Panamax Containers of 15,000 – 15,500 TEU. They are followed by MOL in fourth place, with an orderbook value of US$5.56 billion, a total of 21 vessels consisting mainly of Large LNG vessels of 174,000 CBM. Eastern Pacific Shipping are in fifth place with a total value of US$4.85 billion, the 18 vessels on order in South Korea consist of Containers and LPG carriers.

It should be noted that CMG CGM has the highest number of vessels on order in South Korea, with a total of 38 Containers vessels, ranging from Sub Panamax vessels of 2,000 TEU to New Panamax Containers of 13,000 TEU and a market value of US$3.83 million.

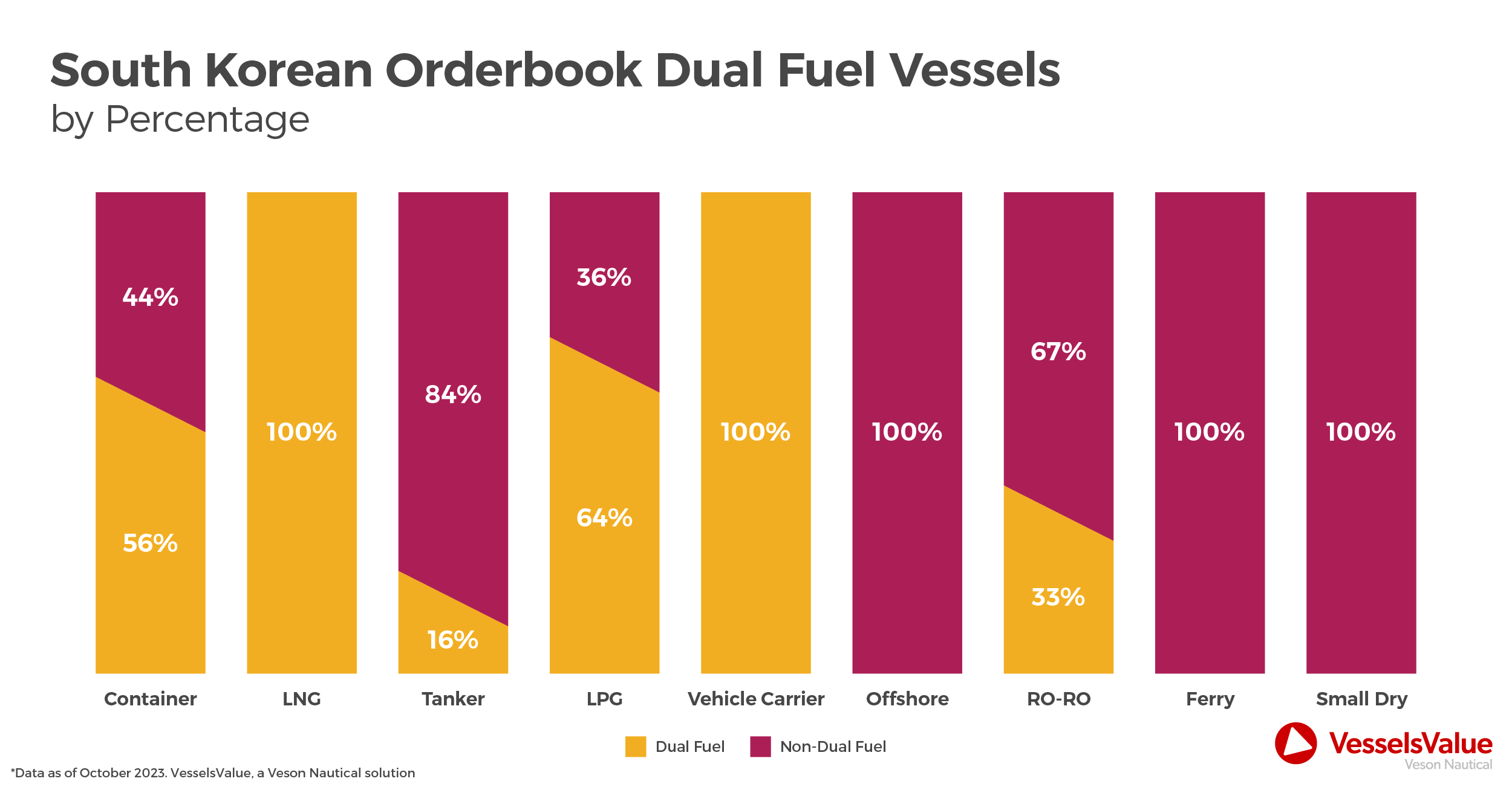

South Korean Orderbook by Dual Fuel Engines

Of the vessels on order in South Korea, approximately 63% are being fitted with dual fuel capabilities, with a market value of US$99.58 million. With the exception of LNG carriers which will always be dual fuel, all Vehicle Carriers on order in South Korea are dual fuel. Within the global orderbook almost all Vehicle Carriers are Dual Fuel spec comprising c.82% of total orders based on 133 ships. This is because the main cargo onboard Vehicle Carriers are factory new OEM (Original Equipment Manufacturer) light vehicles including EVs (Electric Vehicles), and OEMs prefer to transport their light & heavy new vehicles on clean vessels offering lower emission ratings. This has resulted in a higher number of DF ships being ordered by shipowners in the Vehicle Carrier sector relative to other sectors.

The second highest percentage is the LPG sector where 43 vessels dual fuel vessels have been contracted, equating to c.63% of the orderbook. Approximately 56% of the Container orderbook or 147 vessels will be built as dual fuel, with a market value of US$24.39 million.

In summary, Container and LNG carriers account for the vast majority of vessels on order in South Korea both in terms of volume and market value. Greek owners have been very active in fleet renewal, currently accounting for c.19% of the South Korean orderbook. Thanks to the 29 LNG vessels on order, NYK Line is the biggest spender at South Korean yards but in terms of volume, they are overtaken by CMA CGM who have inked contracts for 38 Container ships. The majority of vessels on order are being fitted with dual-fuel engines in a push to meet the latest targets set by the IMO.

Author of South Korean Orderbook Analysis: Rebecca Galanopoulos Jones, Content Analyst, Veson Nautical