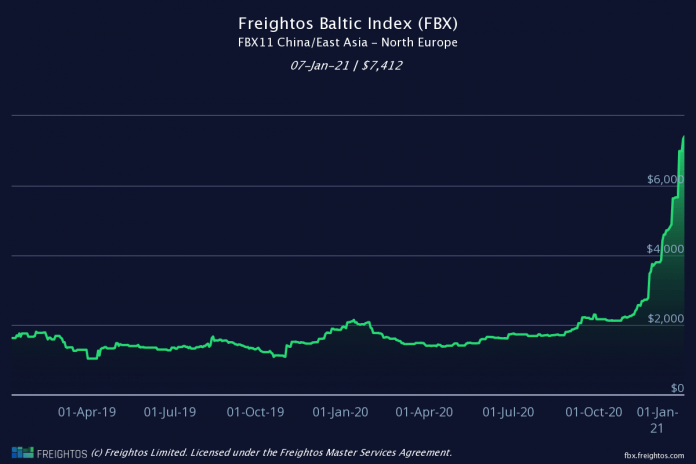

Spiking freight rates have surged by 25% on the Asia to North Europe and the Mediterranean over the last week and now stand at triple the levels seen at the end of October according to the Freightos Baltic Index (FBX).

[s2If is_user_logged_in()]Meanwhile, on the Pacific freight rates dipped 7% to the US West Coast and 8% to East Coast ports, over the past week according to Freightos CMO Ethan Buchman. Rate levels were still more than double the levels of a year ago.

Regulators in China and the US have worked to keep a lid on rate rises over recent weeks and with backhaul rates on the Pacific rising to US$703/FEU from the US West Coast (USWC) and US$769/FEU from the US East Coast (USEC), this and the dip in prices, eastbound on the Pacific have forced up rates to Europe.

“Rates on both lanes [to North Europe and the Mediterranean] are now at the incredible US$7,000/FEU level before surcharges, having tripled since the end of October, and also triple year-over-year. With rates spiking and service suffering, European forwarders and shippers are urging regulators to step in,” said Buchman.

That said, Evergreen Marine Corporation has announced a general rate increase (GRI) for Transpacific services as well as routes to the Far East, South Asia, Middle East, South Africa and East Africa.

Effective 15 February, the week of Chinese New Year, the GRI will be US$900/TEU for dry containers, US$1,000/FEU for both dry containers and reefers and US$1,266 for 45ft dry containers.

While the Chinese New Year holidays in Asia start on 12 February, consultancy Sea-Intelligence said that carriers are expected to have a difficult time planning their capacity management for this year’s holidays, due to the pandemic.

Sea-Intelligence CEO Alan Murphy said, “In a ‘normal’ year, carriers would announce several blank sailings in connection with Chinese New Year, in order to balance supply to the lower container shipping demand, due to factories closing over the lunar holiday. However, 2020 has been far from normal, and there does not seem to be any consensus forecast on the production impact of Chinese New Year in 2021.”

Murphy noted that current blank sailings are lower than in previous years, particularly on the Asia to Europe trades, though that has had no material effect on the rate levels.

In the US Jon Monroe from Worldwide Logistics argues that a slow-down in demand would be a good thing for all concerned, allowing the lines to catch up on the backlog.

“Demand from beneficial cargo owners (BCOs) continues to remain strong through Chinese New Year. There are rumours of a softening of orders, but as of this writing, bookings are backlogged. Should activity slow down, it would first need to slow down enough to allow carriers to catch up with the backlog of containers waiting to be loaded in Asia.”

That backlog will maintain spot rate levels in the coming months as shipping lines and shippers enter into this year’s contract negotiations. One shipper representative told Container News, that reports from shippers of early contract negotiations indicated that they had “not gone well,” from the shipper’s perspective. However, the source added that “It was too early to draw any conclusions” for the bulk of the negotiations, which were still to come.

James Hookham from the Global Shippers’ Forum, believes the major issues for cargo owners is the fact that the rising costs of freight have not been recoverable, but also that the higher rates do not have a basis in the costs incurred by the lines, “If shippers feel that this is the new normal, that they’re [the lines] are serious, then that would be a problem,” argued Hookham.

That was one of the many questions posed by Monroe when looking at the upcoming negotiations with non-vessel operating common carriers (NVOCCs).

“Has control of the Transpacific business shifted from a balanced negotiation to a carrier dictate? It is very possible that new contracts will show more of a gap between NVOCC and BCO rates. But can you trust the carriers? Is the only way they can service a BCO is by trying to manage a rate differential? Why can’t carriers and NVOCCs work together? After all, the NVOCCs have boots on the ground that are trained to handle the first mile and last mile. 2021 will be a milestone year for carrier negotiations and very telling for the carrier NVOCC relationship.”

[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]

Martina Li Nick Savvides

Asia Correspondent Managing Editor