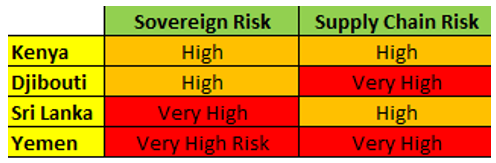

The following analysis focuses on key nations that are pivotal to the maritime trade in the Indian Ocean, specifically Sri Lanka, Yemen, Djibouti and Kenya.

These countries serve as critical nodes in the global shipping network, and their political and economic stability plays a significant role in ensuring the free flow of maritime container trade.

As the first step in our analysis, we have chosen to assess the political instability in each of these countries. This will allow the uncovering of the relationship between political instability, the Houthi attacks on the Red Sea, and its impact on the container shipping side, focussing on potential disruptions in the port throughput of the examined countries.

This group of nations was selected not only for their importance as trade hubs but also because of their ongoing political instability, a factor that could significantly impact maritime trade across the entire region. The interplay between these factors will be explored in depth to assess how political turbulence affects the Indian Ocean’s critical shipping routes.

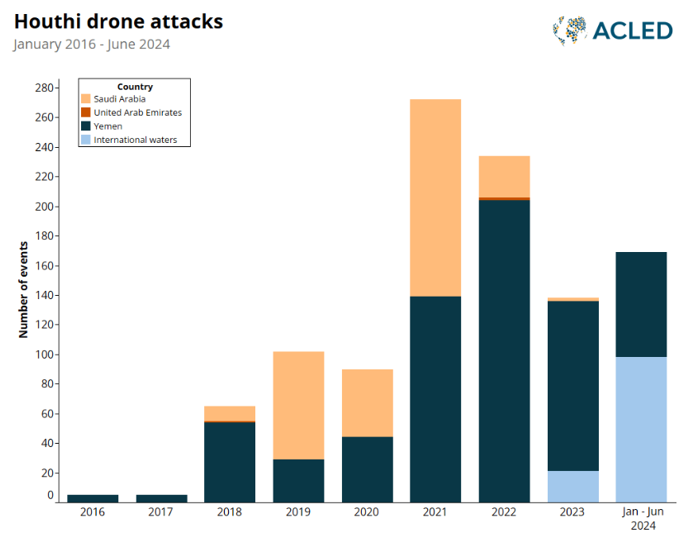

It is important to note that while Yemen does not play a major role in the container shipping sector directly, its political situation is profoundly affecting the other countries in the system. The ripple effect of the Yemeni crisis is seen in neighboring Djibouti, Sri Lanka, and Kenya, where shifts in trade patterns and regional security concerns emerge.

Kenya’s high sovereign risk indicates potential concerns that could lead to uncertainty in regulatory environments and potential disruptions, while the high supply chain risk further underscores vulnerabilities in logistics and infrastructure. For maritime trade, these factors may translate into challenges such as port congestion, delays, and increased costs.

Djibouti’s high sovereign risk combined with very high supply chain risk paints a picture of severe vulnerabilities. The very high supply chain risk likely reflects significant challenges in port infrastructure, operational inefficiencies, and logistical bottlenecks. Djibouti’s geopolitical importance and risk profile suggest that any instability or inefficiencies here could have broader implications for regional trade.

Sri Lanka’s very high sovereign risk indicates substantial issues with political instability, economic governance, and policy continuity. This high level of risk can affect investor confidence and economic stability. The high supply chain risk suggests that while logistics and infrastructure challenges are present, they may not be as severe as those in Djibouti. However, disruptions in Sri Lankan ports and logistical operations could still significantly affect regional trade, especially considering its role as a major transit point in South Asia.

The combination of heightened Houthi attacks in Yemen since November 2023, which have targeted at least 185 commercial vessels in the Red Sea, reveals that there is a discernible correlation between these attacks and the risk indicators. The attacks not only destabilized Yemen but also disrupted global shipping lanes, and increased risks for other countries in the region. Yemen’s very high risks are directly influenced by the attacks, while Djibouti and Kenya faced exacerbated challenges due to the disruptions in regional maritime routes. Sri Lanka, although indirectly affected, still experiences some impact from the broader regional instability.

Regarding the port activity in these countries, the research revealed some interesting trends. Sri Lanka showed a recovery trend in port throughput in 2023, despite high sovereign risk, while Kenya also showed a positive port performance, with significant growth in cargo handling and transit traffic. Meanwhile, Djibouti’s growth in container throughput amidst high sovereign and very high supply chain risks indicated that improvements in port infrastructure and regional trade have played a crucial role in mitigating some of the adverse effects of political instability.

It seems that all three countries—Sri Lanka, Kenya, and Djibouti—demonstrated resilience in their port activities despite varying levels of political instability. It can be concluded that strategic investments in infrastructure have helped mitigate some negative impacts of political instability on port throughput and cargo handling. Undoubtedly, the growth and recovery seen in these ports reflect their resilience and adaptation to the changing maritime environment, influenced by the disruptions in the Red Sea.

As an overall conclusion, it can be said that the increased use of alternative ports in the Indian Ocean, like those in Kenya and Djibouti, shifted the dynamics in maritime trade routes caused by the instability in the Red Sea, while ports such as Djibouti and Mombasa have seen increased cargo handling and transit traffic, partly due to rerouting from the Red Sea.

Alexandros Itimoudis

Shipping Analyst