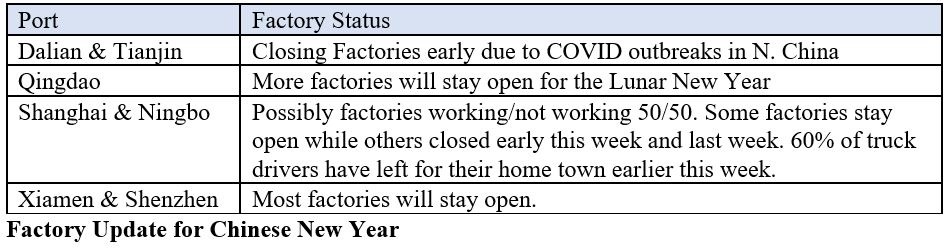

Staff from factories and truck drivers in China have ignored incentives to work through the Chinese New Year and have headed home for the New Year celebrations, according to Worldwide Logistics consultant Jon Monroe.

[s2If is_user_logged_in()]Beijing has announced that travellers must quarantine for 14 days when they reach home and a further 14 days when they return to their place of work, with a seven day New Year holiday the total period for the lunar holiday could be as much as 35 days. With the seven-day New Year period starting on 12 February, quarantine will have already started for many.

“It seems most truck drivers opted to go back to their home-town for the holidays,” explained Monroe. While some factories had already closed by mid-January, around 22 January.

Monroe went on to say, “It is my understanding approximately 60% of the truck drivers in the Yangtze River Delta (Shanghai and Ningbo) left earlier this week [week beginning 25 January] for their home-town. This is resulting in many cancelled bookings as vendors that shut down will not be available to load containers.”

On the other side of the Pacific, similar events are occurring, in as much as there are staff shortages in key areas.

According to Container xChange latest data, after struggling to cope with excess containers for much of last year, the Port of Los Angeles is now facing box shortages.

“US container shipping supply chains have been under pressure since the summer and now the Port of LA is coping with an outbreak of Covid-19 and labour shortages. While earlier in the year the high-volume US box import port was overwhelmed with boxes, now there is a dearth,” said Dr. Johannes Schlingmeier, CEO of Container xChange.

Chaotic scenes on the US West Coast will not be helped by the fact that demand remains “as strong as any peak month,” according to Monroe, who is offering a bold analysis of the changes in the US retail market.

Walmart is developing micro fulfillment centers at dozens of its stores. Target had a smashing year and is positioned to benefit from the expected mall closures in the coming years. Target over the years unknowingly prepared for this pandemic having put a lot of investment into its supply chain and fulfillment infrastructure. Target’s holiday comparable sales were up 17.2% and digital comp sales were up 102%, said Monroe.

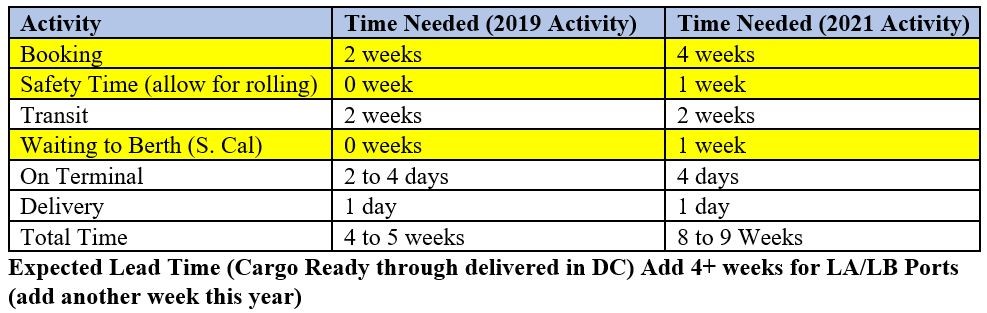

Smaller shippers are suffering, however, with container freight rates remaining high and the chronic shortage of boxes persisting. Congestion at Southern Californian ports has left many shippers scrambling “for alternate routings just to break the logjam,” at Los Angeles and Long Beach.

Delays of 15 days in LA and Long Beach, 8-10 days waiting at anchorage and up to five days offloading are common, but that could be longer if there are no chassis to load your container.

Monroe paints a bleak picture, “Everyone seems to be paying demurrage at some point. If the shipments are headed inland, that is a different story. Trains destined for Minneapolis and Chicago have been delayed due to the lack of chassis at the rail ramps. Trains between Seattle and Minneapolis have sat on side-tracks for weeks.

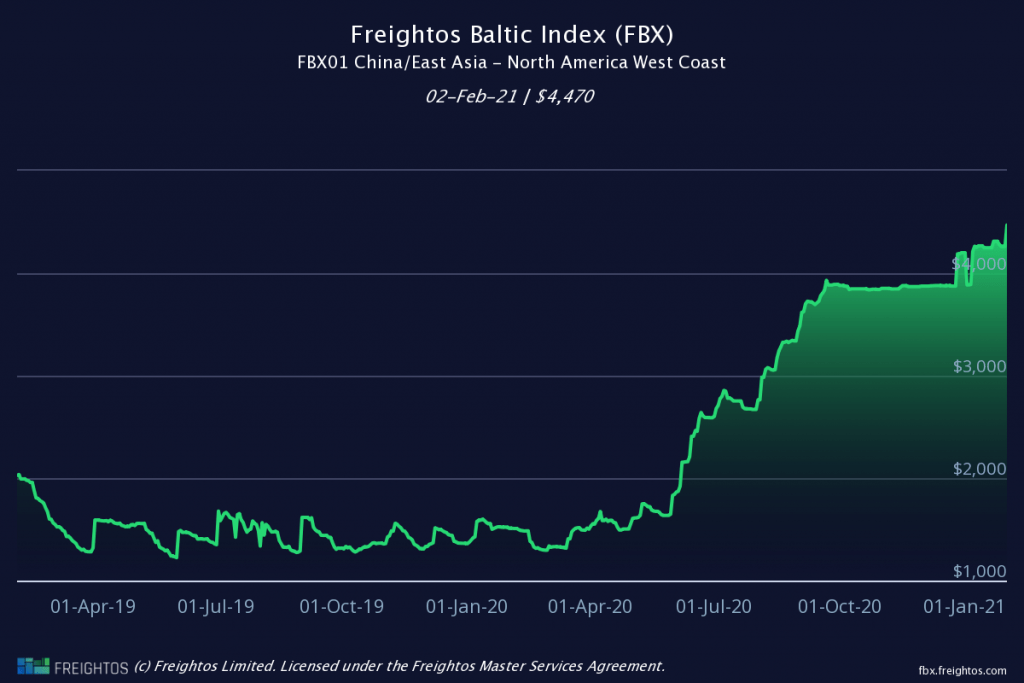

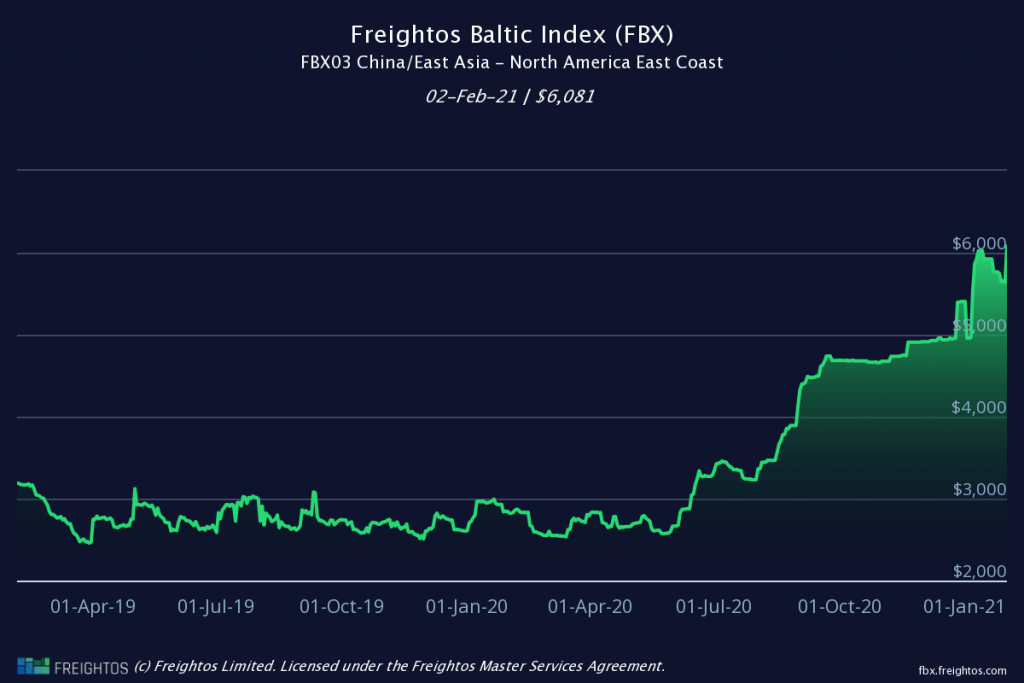

Non-vessel operators are also struggling to find equipment, according to Monroe, and the prices have stabilised at around US$3,700/FEU to the US West Coast (USWC) and US$4,700/FEU to the East Coast (USEC). Typically, airfreight has been five to six times the cost of ocean freight, but that gap has virtually closed, and air cargo may well be an option for many shippers trying to fulfill customer orders.

Spot rates to the USWC on the Feightos Baltic FBX index were at US$4,470/FEO on 2 February, they did dip slightly over the previous week, but this week the upward trajectory has resumed and surpassed the previous peak. The FBX 03 index to the USEC followed a similar pattern, dipping before crashing through the US$6,000 mark, reaching US$6,087/FEU on 2 February.

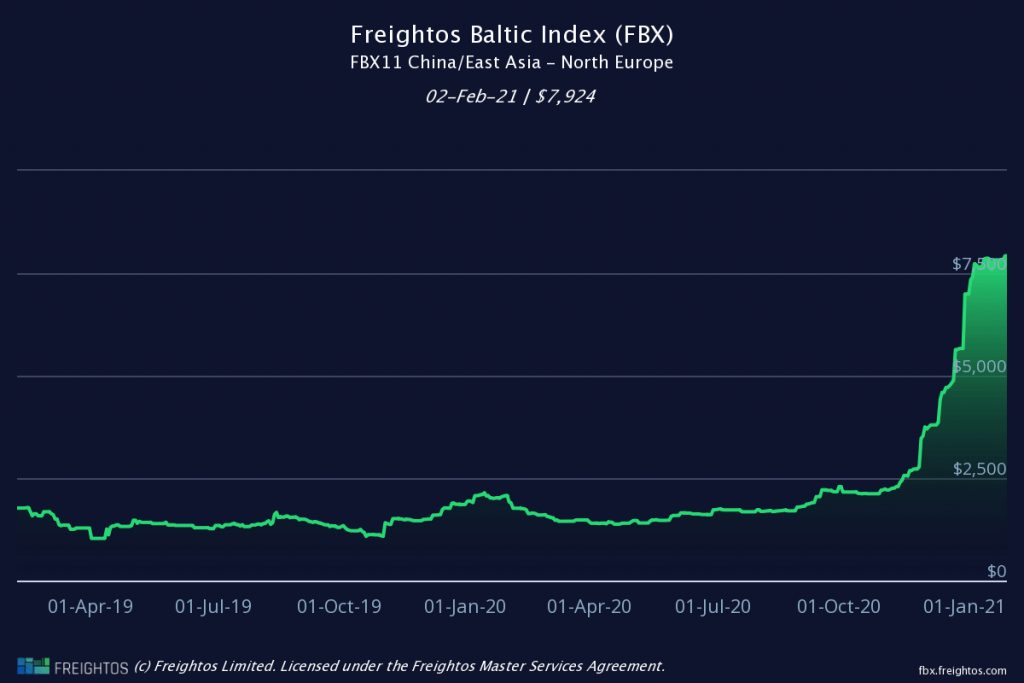

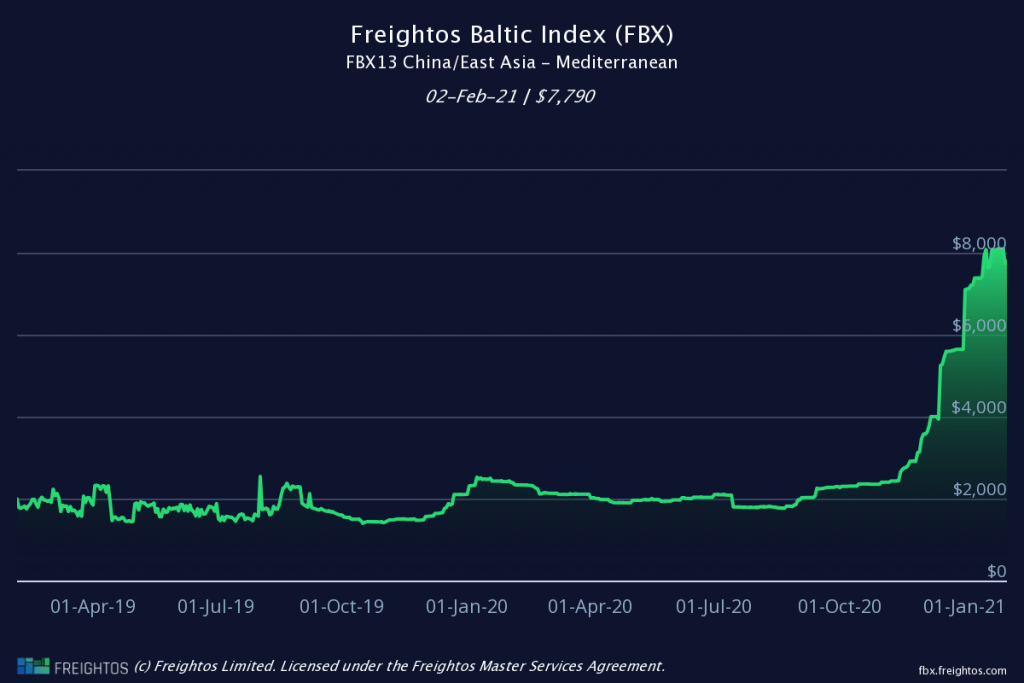

Asia to Europe spot rates did not bother declining by much before resuming their upward mobility, standing at US$7,924/FEU to North Europe and US$7,790/FEU to the Mediterranean. Though the price has fallen from a high of just over US$8,000/FEU late last week.

Alan Murphy, CEO at Sea-Intelligence believes that with spot rates at these levels, carrier pricing has come under the spotlight.

“The term ‘price gouging’ is traditionally applied to consumer pricing, not B2B-pricing, and in most legal jurisdictions, such as in the US States with price gouging laws, such laws are usually only applied during civil emergencies or when a company is seen to misuse a dominant market position, and often such laws are applied to price increases of more than 10-15% during a civil emergency,” explained Murphy.

Spot rates, said Murphy, are volatile and fluctuations of “more than 15% are quite common.”

A clear legal case for a B2B industry would be hard to make, added Murphy, and “current spot rate increases are not necessarily out of the norm.”

Nevertheless, Murphy concedes, “carriers in their pricing behaviour have prioritised short-term profitability over customer relationships, and for shippers with low-value commodities, the development is nothing short of a disaster, as they are effectively being priced out of the market.”

Sea-Intelligence believes that the carriers had a choice to make, either to capitalise on those shippers willing to pay the premium prices, “improving short-term profitability,” or maintain stable rates that would help smaller shippers and those with lower value cargo.

It seems the carriers opted for the first option and this “means that there is a large intangible price to be paid by the carriers, as the current approach has severely strained many customer relationships,” noted Sea-Intelligence.

With rollover cargo statistics still at just under 40% in most major export terminals, according to Ocean Insights data, and with around 40 ships at anchorage outside of the Southern California ports, and delays to cargo of up to five weeks, shippers could be forgiven for wondering what they are paying for.

Nick Savvides

Managing Editor[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]