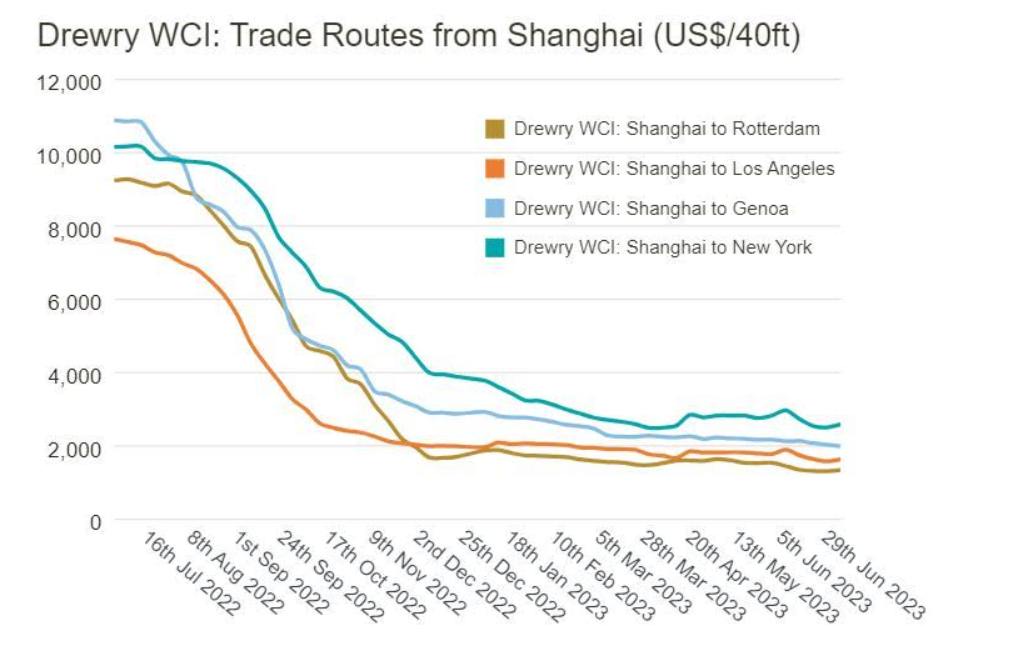

A 25% tumble in the transatlantic rates, Rotterdam to New York at US$2,003, awarded the Drewry World Container Index with its lowest ever level since 15 November 2019 and with that officially at its lowest quote in the post-pandemic era.

The transatlantic rates which have shaved off nearly 39% in a mere fortnight, about US$1,223, have now eroded 73% since their peak in November 2022, and are currently lingering at levels last seen around Christmas in 2020.

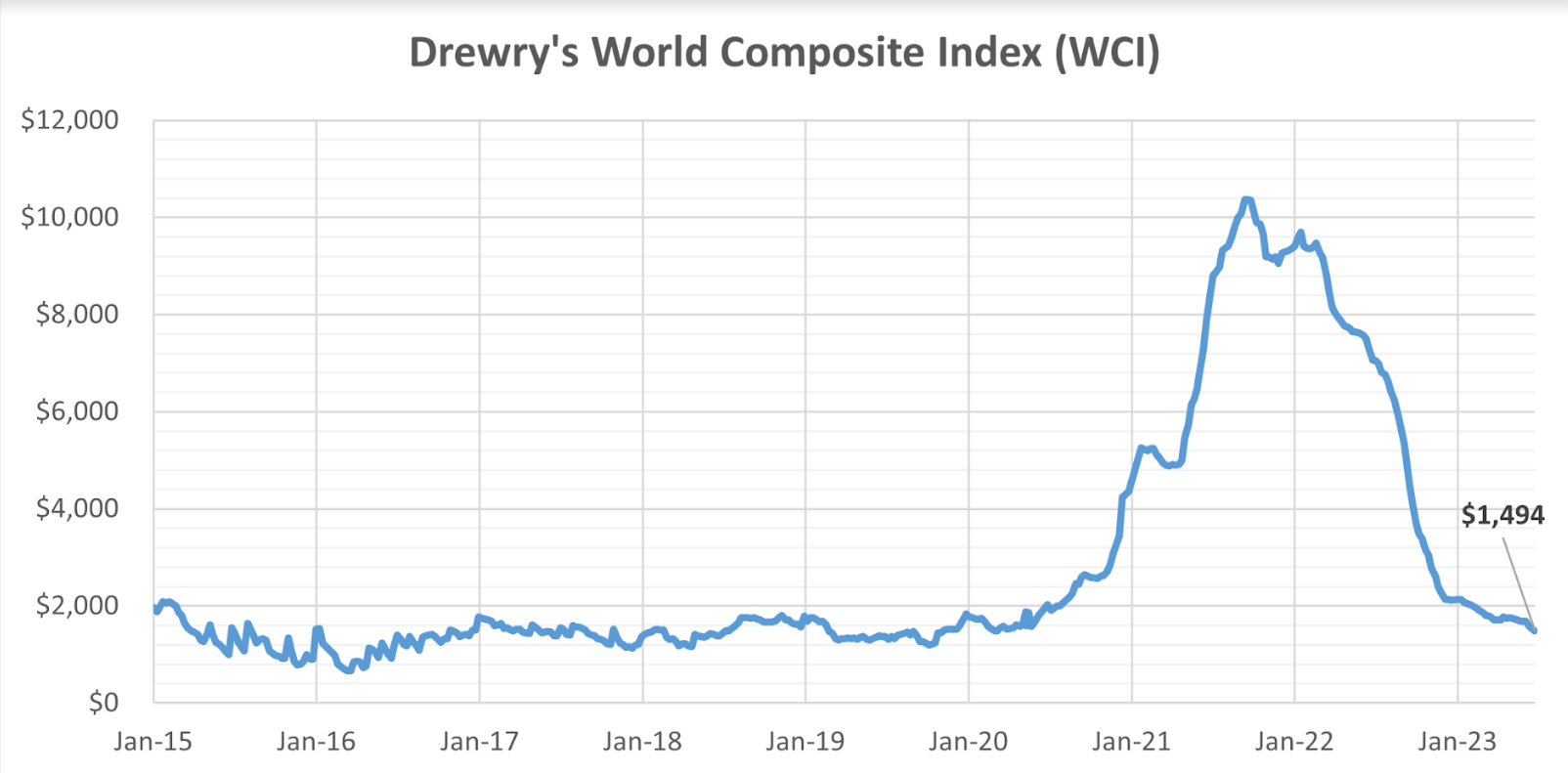

The Drewry World Container Index (WCI) ended at US$1,474 losing 1.3% for the week with an erosion of 86% from its peak in September-2021.

The weekly composite rates were held by gains across the transpacific trade. The Shanghai- Los Angeles, China- US West Coast, rates rumbled past the status quo by registering a 4% weekly gain to end at US$1,638 while the pricier China- US East Coast rates, Shanghai- New York, appreciated by 3% to end at US$2,590.

Accompanying them were the headhaul rates for Shanghai-Rotterdam, which registered a 2% gain to end at US$1,344. There was weakness seen in backhaul rates this time with the Rotterdam-Shanghai rates depreciating 5% while Los Angeles- Shanghai which had held on to its four-digit territory slumped 14% to end at US$876.

The general consensus and sense is that of a market that has a weak demand and abundant supply. With GRIs coming back in certain trade lanes on a case-to-case base by shipping lines, it remains to be seen at the end of the month, if these can have repercussions to cushion the fall in rates.

The latest Caixin S&P PMI data from China still shows 50.5 for June 2023 as against 50.9 for May 2023. Additionally, any shoots of growth were led by domestic market as the export scenario remained grim, owing to a bleak demand scenario.

The Xeneta long-term rates for June 2023 had also reported over a 9% dip, indicating the weakness in contract market too. Drewry has maintained a negative commentary akin to the last week of June, as it sees spot rates on East-West trade decline in coming weeks.

Author of the article: Gautham Krishnan

Gautham Krishnan is a logistics professional with Fluor Corporation, in the area of project logistics and analytics, and has worked in the areas of Project Management, Business Development and Government Consulting