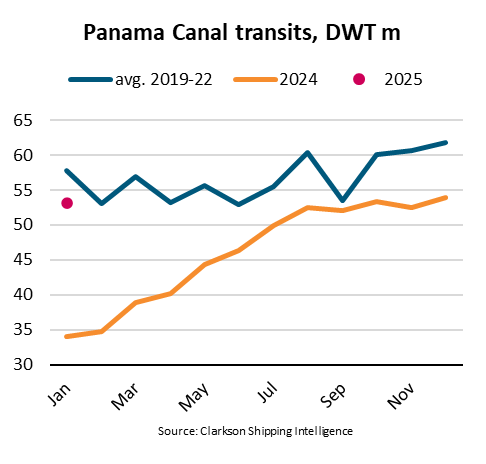

In this week’s “Shipping Number of the Week” from BIMCO, Shipping Analysis Manager, Filipe Gouveia, examines Panama Canal transits which have declined in recent months despite the fact that transit restrictions have been lifted.

“Between September 2024 and January 2025, ship capacity in deadweight tonnes transiting through the Panama Canal was 10% lower than the 2019-22 average. Although there were no transit restrictions during this period, transits of dry bulk, LNG and, to a lesser extent, tanker ships have not recovered to their historical levels,” mentioned Filipe Gouveia, Shipping Analysis Manager at BIMCO.

Between June 2023 and September 2024, transits through the Panama Canal were restricted due to low water levels in Gatun Lake. There were restrictions to both the total number of transits and ship draft, and ships competed for limited transit slots. Sectors such as the container sector typically operate on fixed schedules which allow them to book the transit slots ahead of other ships. Non-bookable transit slots were also auctioned, usually favouring the highest bidder and thereby offering an advantage to some sectors.

“Transit fees, changes in trade patterns and the establishment of a new normal could all be keeping ships from fully returning to the canal. Furthermore, for the sectors which haven’t fully returned, this has resulted in increased tonne mile demand as sailing distances have increased. Instead of transiting through the canal, ships sail around the Cape of Good Hope or Cape Horn,” added Gouveia.

For the dry bulk sector, a change in trade patterns for US grains, the largest cargo transiting through the canal, has contributed to a reduction in Panama Canal transits. The US is increasingly exporting grains from ports on the US West Coast, bypassing the canal. Since September, grain shipments from the US West Coast to ports in the Pacific have risen 21% y/y, whereas shipments from the Gulf have fallen 6% y/y.

Coal cargoes also remain significantly below pre-restriction levels, as ships have largely continued to favour alternative routes. Conversely, minor bulk cargoes transiting the canal are nearing pre-restriction levels, driven by stronger steel and fertilizer cargoes.

In the LNG sector, ships have hardly returned to the Panama Canal due to safety concerns related to their cargo. Few transit slots are offered to the sector, and no overnight transits are allowed. Consequently, routes around the Cape of Good Hope or Cape Horn have been perceived as more reliable and flexible.

“Although a return to the canal has been slow for some sectors, we still expect ship capacity transiting the waterway to increase. Transits of container, LPG and car carriers are already above historical levels and could continue growing. However, the medium-term outlook for the dry bulk sector looks cloudier amid strong competition for grains shipments between the US and Brazil and a poor demand outlook for coal,” mentioned Gouveia.

The article was provided by BIMCO.