China’s National Bureau of statistics reported a 13.5% year-on-year decline in industrial output in the first two months of 2020, the most substantial contraction on record.

In addition, Chinese retail sales fell 20.5% in January and February while fixed asset investments slumped by virtually a quarter of the amount seen this time last year.

The effects of the coronavirus outbreak could cost the global economy as much as US$2 trillion, according to the United Nations Conference for Trade and Development (UNCTAD), ship broker Braemar reported.

In its weekly weekly round-up Braemar said, “The [UNCTAD] forecast was made as part of a ‘Doomsday scenario’ in which the world economy only grows by 0.5% due the [Covid-19] outbreak and the collapse in oil prices.

In its weekly weekly round-up Braemar said, “The [UNCTAD] forecast was made as part of a ‘Doomsday scenario’ in which the world economy only grows by 0.5% due the [Covid-19] outbreak and the collapse in oil prices.

However, UNCTAD pointed out that the cost to the global economy will most likely be half of its doomsday forecast as there is uncertainty as to whether there will be a breakdown of supply chains.

“We envisage a slowdown in the global economy to under 2% for this year, and that will probably cost in the order of US$1 trillion,” said UNCTAD.

Doomsday scenarios have not prevented the ordering of more mega-vessels with OOCL’s five ship order for 23,000TEU behemoths, followed eagerly by Ocean Network Express’s (ONE) tenders for large carriers.

Braemar said, “ONE’s tenders are approaching a conclusion after a two week break due to the Covid-19 virus outbreak. The first tender is for six 23,000TEU with dual fuel in buyers’ option and the second is for six 15,000TEU vessels, again with dual fuel in buyers’ option.”

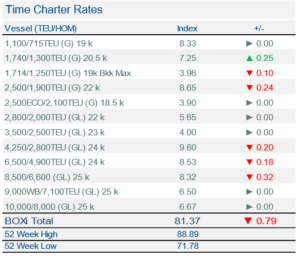

Even so the viral outbreak is having a significant effect on the charter and sale and purchase markets with owners finding it difficult to find a port where crew changes can take place as entire regions in Europe and Asia shut down in an attempt to contain the virus. And few vessels available for hungry buyers.