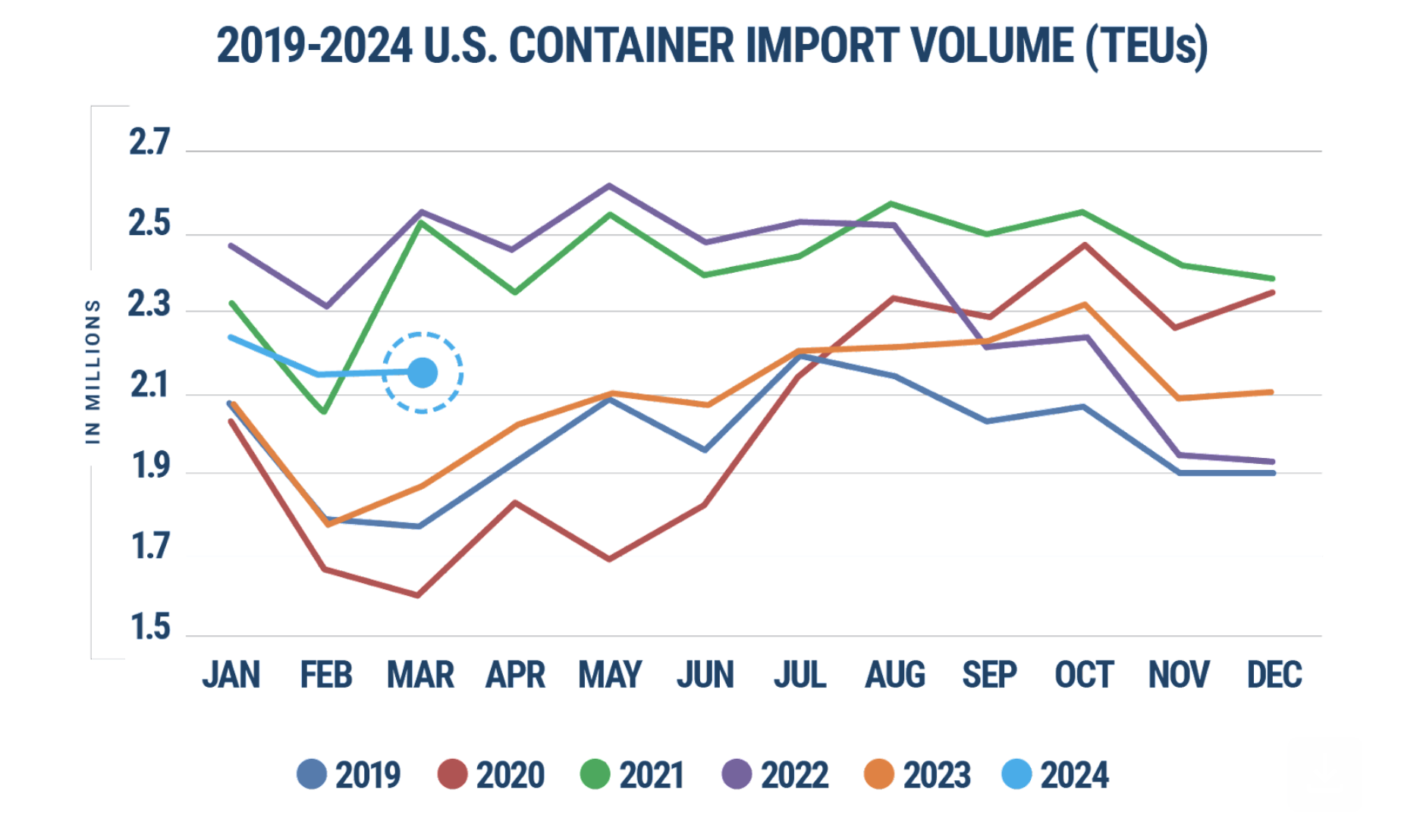

In March, US container import volumes saw marginal growth compared to February, edging up by only 0.4% to reach 2,145,341 TEUs.

However, TEU volumes experienced a significant increase of 15.7%, compared with the same month last year, and marked an even larger increase of 20.6%, compared with pre-pandemic levels in March 2019.

Notably, the impact of the Chinese Lunar New Year might have obscured even stronger growth, as the holiday commenced on 11 February and extended throughout the week, delaying its influence on US imports until the latter half of March.

To provide a clearer perspective, Descartes conducted a comparison between the first 15 days of March 2024 and the corresponding period in 2023, as these intervals were less susceptible to the effects of the Chinese Lunar New Year. Within this timeframe, US container import growth stood at 22.7%.

Figure 1: U.S. Container Import Volume Year-over-Year Comparison

“Considering declining import volumes from China, March 2024 was a strong month and continues the robust performance that began in January 2024. Despite the combined effect of the Panama drought and the conflict in the Middle East, port transit delays showed continued improvement across nearly all the top ports, as March volumes at East and Gulf Coast ports remained stable,” stated Chris Jones, EVP Industry, Descartes.

According to the report, compared to February, March US imports from China continued to decrease due to the Chinese Lunar New Year, leading to a notable decline in volume at the Port of Los Angeles in California for the second consecutive month.

Despite concerns, transit delays at East and Gulf Coast ports are showing signs of improvement, unaffected by the Panama drought and Middle East conflict. Descartes’ logistics metrics update for April indicates a robust beginning for US container imports in the first quarter of 2024.

However, ongoing issues such as those at the Panama and Suez Canal, forthcoming labour negotiations at US South Atlantic and Gulf Coast ports, the Middle East conflict, and the aftermath of the Baltimore Bridge collapse are expected to impact global supply chain performance throughout the year. The impact of the Baltimore Bridge collapse on US container import volume data is yet to be fully realized.