Danish research and analysis company Sea-Intelligence has conducted research for the latest sales in August and inventory data, released by the US Census Bureau, to see what they mean for container shipping.

Firstly, the company examined the inventory to sales ratio. The two-stage drop in relative inventory levels seen in June-August 2020 and from December-March 2021, did not reverse in August, with the relative inventory levels remaining at the same low levels, as has been the situation since April 2021.

“This development implies that the continuing import boom of cargo into the United States is only sufficient to keep pace with sales, but not sufficient to rebuild inventories,” commented Alan Murphy, CEO of Sea-Intelligence.

However, regarding the inventory to sales ratio for the business categories of manufacturers, retailers, and wholesalers, it has been on a declining trend for both manufacturers and wholesalers, and stable since April 2021 for retails, according to the report.

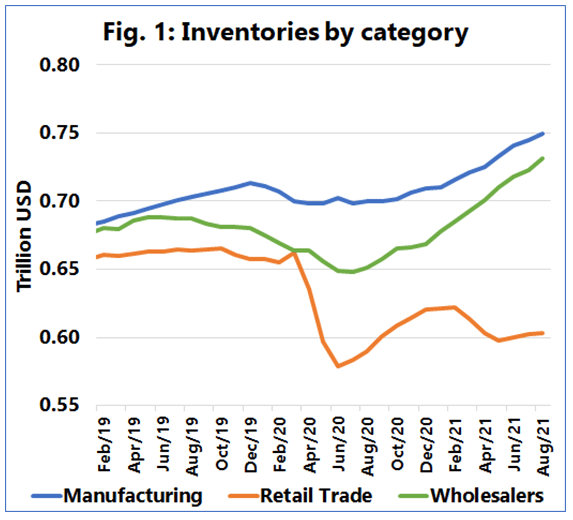

As for the underlying inventory levels (shown in the figure above), the inventory replenishment for manufacturers and wholesalers continues to grow rapidly, and in both cases, the levels are now above any previous level measured since the data started in 1992. For retailers, however, there has been a continued very low level of inventory, according to Danish researchers.

Part of the physical problems in the supply chain in the US is capacity problems in the warehouses. “Seen from the perspective of the inventory size measured in US$ value, we are indeed in August at a new record high level of US$2.08 trillion,” pointed out a Sea-Intelligence analyst.

This reflects an increase of 7.4% compared to the previous August but also only a 1.4% rise over August 2019. From that perspective, it appears a little perplexing why a 1.4% increase over two years should cause such problems.

The reason is that whilst the overall inventory change is not substantial, there is instead a massive shift in terms of the business sectors holding the inventory, with manufacturers and wholesalers up by 6% to 7% over August 2019 and 7% to 13% up year-on-year.

“This is very likely part of the problem, as some sectors see rapidly escalating inventories, meaning they need to get more warehousing space leading to the shortages, whereas other warehousing space is held by sectors not seeing an increase,” noted Murphy.