With spot rates falling faster than what seasonality would suggest on most major trades, market participants are anxious to gauge whether this means a weaker peak season than the record-breaking peak seasons of the past two years.

The reason that freight rates have reached record levels is a lack of vessel capacity, which also means that any solution, before the delivery of new ships in 2023, will have to come from the easing of import demand from the United States, according to maritime data analysis company Sea-Intelligence, which has analysed the latest US consumer spending data released by the US Bureau of Economic Analysis (BEA).

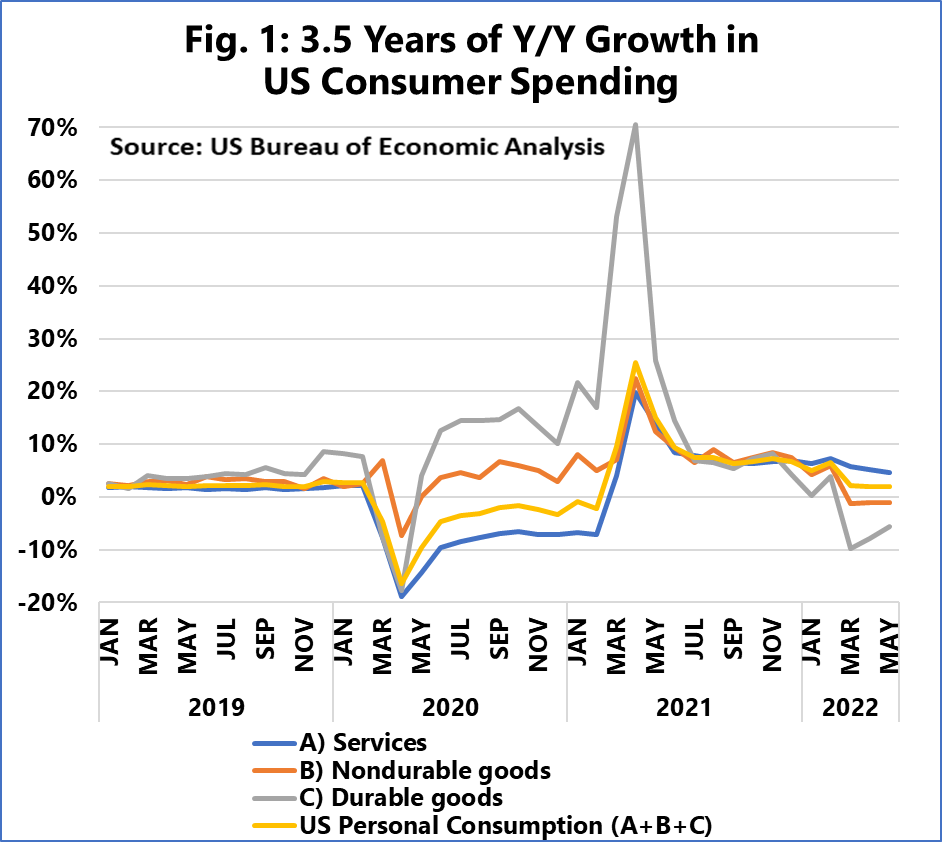

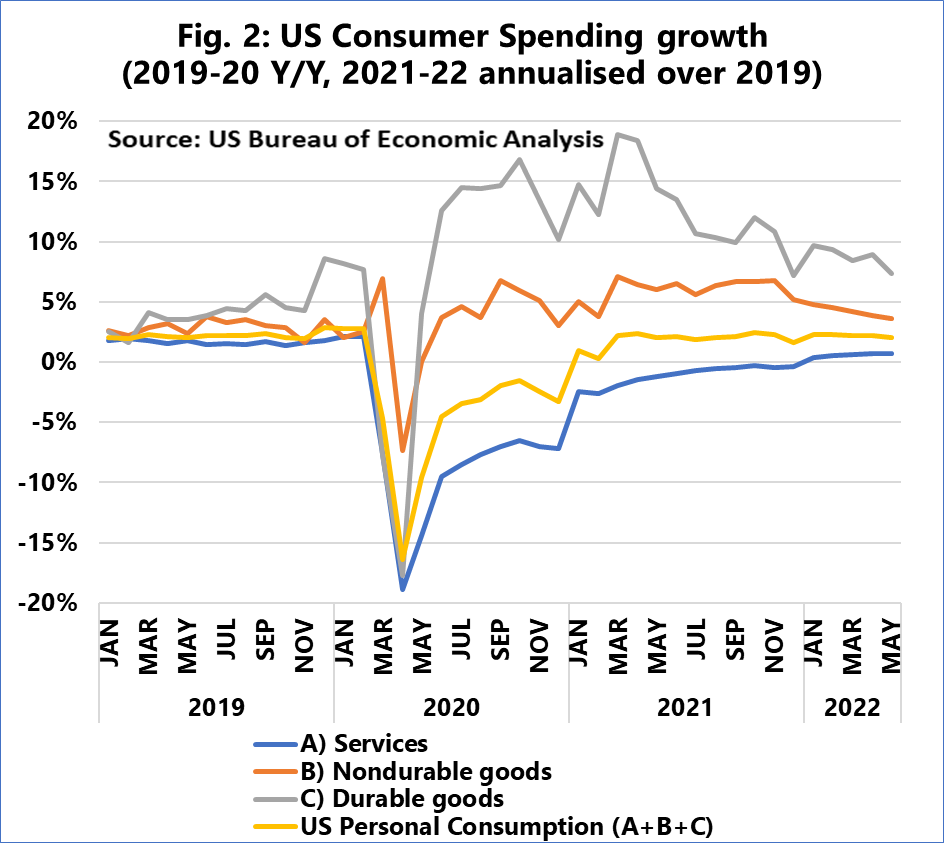

Figure 1 shows year-on-year growth in consumer spending, while figure 2 shows the same, but with year-on-year growth in 2019. There are two main takeaways, according to Alan Murphy, CEO of Sea-Intelligence.

First, it should be noted that while 2021 growth was severely impacted by the extremely low base of 2020, it is also clear that there was very good growth in Durable Goods in 2021, far exceeding any level in the past 20 years.

Second, a downward trending but positive annual growth rate, such as that for Durable Goods from April 2021, means that underlying growth (or contraction) gets progressively worse, as each additional year must offset an increasing number of higher growth years.

Taking both these figures together, the Danish consultants conclude that compared to last year, Durable Goods spending has been contracting at a Y/Y rate of 6-10% in March to May, and with a longer-term annualised view, Durable Goods growth is slowly moving towards the pre-pandemic level.

“This means that while we don’t get a definitive answer as to the strength of the peak season, we do see very clearly that the unprecedented strength of the Durable Goods consumption has slowed down in recent months,” said Murphy, who went on to add that “we are not seeing a boom or a crash in the market, but rather one that looks headed for a gradual return to the slower pre-pandemic levels.”