Over the coming three weeks the trajectory of the Covid-19 virus will become more apparent and the issues around the supply chain will become clearer according to forwarding sources in the US.

Trading over the next three weeks will be tough with 150 retailers closed, with no indication of when they will reopen, and that means a severe decline in demand will necessarily follow, if it is not already occurring.

“According to Neil Saunders MD at Global Retail Data, 190,000 stores representing 50% of the retail square footage is closed indefinitely as a result of COVID-19. The topic on everyone’s mind now, is how soon can this country re-open? Until we re-open, we have little demand. When demand drops so do the containers coming into the US,” said the US source.

In order for demand to pick up the lockdown, which has lasted just four weeks in the US, must be lifted, a process that was better managed in Wuhan, China, and still took nearly three times as long as the US closure to date.

“This opening came only after 11 weeks of being shut down. And, they only allowed people out who had no symptoms, no fever and had never been infected,” said the forwarder, adding, “This was a carefully planned re-opening. People who had been infected and recovered began a two-week quarantine while those still infected were isolated at home. Still infected after 11 weeks? Really? How can we re-open after 4 weeks?” He asked incredulously.

US consumers and the logistics industry need to buy time because the lockdown in China was strict and effective, but the US has not been as stringent in its control of the population, meaning that the probable outcome will be a longer period of shut down for the US than in Wuhan.

Contract negotiations between larger shippers and carriers are well under way now, and should be concluded by the third week of April, with rate proposals similar to last year’s rate levels. Small and medium sized beneficial cargo owners (BCOs) are also in the latter stages of their negotiations with the carriers and there is said to be an understanding of the shippers’ concerns over the minimum quantity commitment (MQC) with so much uncertainty over how the return of consumers will take place following the end of the crisis.

“Carriers seem to understand the dilemma that many BCO’s have in determining their MQC. What will demand look like when they reopen? Will consumers come back into the stores? How much of their product can they sell online? We have heard that carriers are sensitive to these issues and companies seemingly can get similar rates as last year with lower MQC volumes,” said the source.

This year free time for containers and chassis will be a key item in contract negotiations, but carriers will want to keep fixed rates at the same level as last year as much as possible.

Freight forwarders are in a similar position as BCO negotiators in that they are concerned about MQC’s and terminal-to-door deliveries, but negotiations with most forwarders are only just getting under way, with only a few early deals having been concluded.

Rates, according to the Freightos Baltic Index (FBX), on the Pacific have shown a marked increase, up 5% between China and the US West Coast, to an average of US$1607/FEU, while on the trades to the US East Coast rates have fallen slightly, 1% to US$2,780/FEU. With the major element of US containers heading to the West Coast rather than through the Panama Canal.

Carriers have managed to maintain rate levels through the careful management of capacity.

Container News understands that, “The carrier alliances are pulling vessels and changing port rotations of remaining strings to allow them to add a port call in order to fill the vessel while using fewer strings. This has changed transits in many rotations adding one to two days to a transit from many ports.”

Nick Savvides

Managing Editor

Current Contract Status of Key Carriers

COSCO/ZIM – still under BCO negotiation, only small part of BCO signed . NVO’s at initial offer stage.

APL – NVO negotiation starts from this week

HPL – Already offered first round base port fix rates. Since HPL doesn’t sign with lots of BCO, they may start negotiating with NVOs in the following days

ONE – First round NVO negotiation has started this week. ONE wants all NVOs to send the proposal of general fix NAC, MQC and ratio by 4/15. After 4/15, NVO still can change or add some of fix NAC. The sign is ONE want to speed up the fixed contract negotiation and they may need more fixed biz from NVO.

OOCL-only finished less than 50% of BCO. NVO not yet started . They will review the NVO policy after BCOs basically done , how many space/MQC budget left for NVO and rate levels

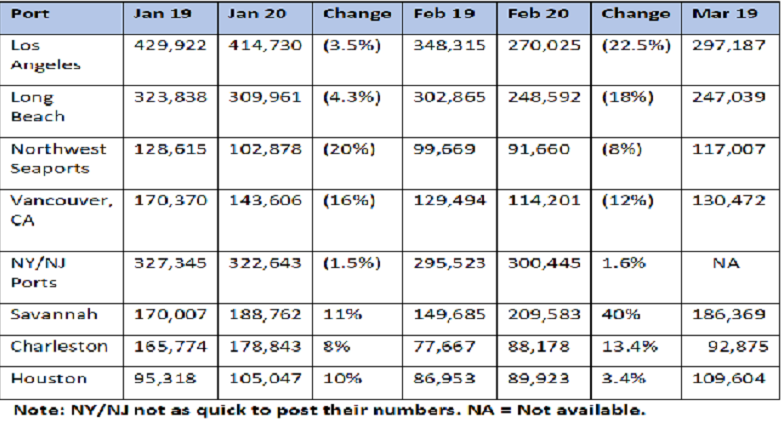

Key US Port Import Performance