Digital technologies have the potential to significantly transform how various components of maritime operations work together, from administrative and logistics functions to ship and terminal operations. This technological evolution impacts five key areas: rates, booking, documentation, customs procedures, and supply chain control/visibility.

According to a report by the International Transport Forum (ITF), emerging technologies, including the Internet of Things (IoT), blockchain, and artificial intelligence, are poised to revolutionize logistics processes. Artificial Intelligence, more specifically, is being applied to optimize everything from cargo movement within ports to predictive maintenance of port equipment. Despite these innovations, the assumption that automated ports are universally more productive than conventional ones is not necessarily accurate. The ITF report emphasizes that, in practice, automated ports often fall short in terms of productivity when compared to their traditional counterparts. A 2017 McKinsey survey revealed that the productivity of automated ports was 7-15% lower than that of non-automated ports, countering the prevalent belief that automation alone leads to higher efficiency.

For these technologies to fully transform ports, it is necessary to address the productivity gap between automated and conventional ports. Container News decided to focus on key US ports and conducted research to reveal the extent to which these ports have incorporated AI technologies into their procedures.

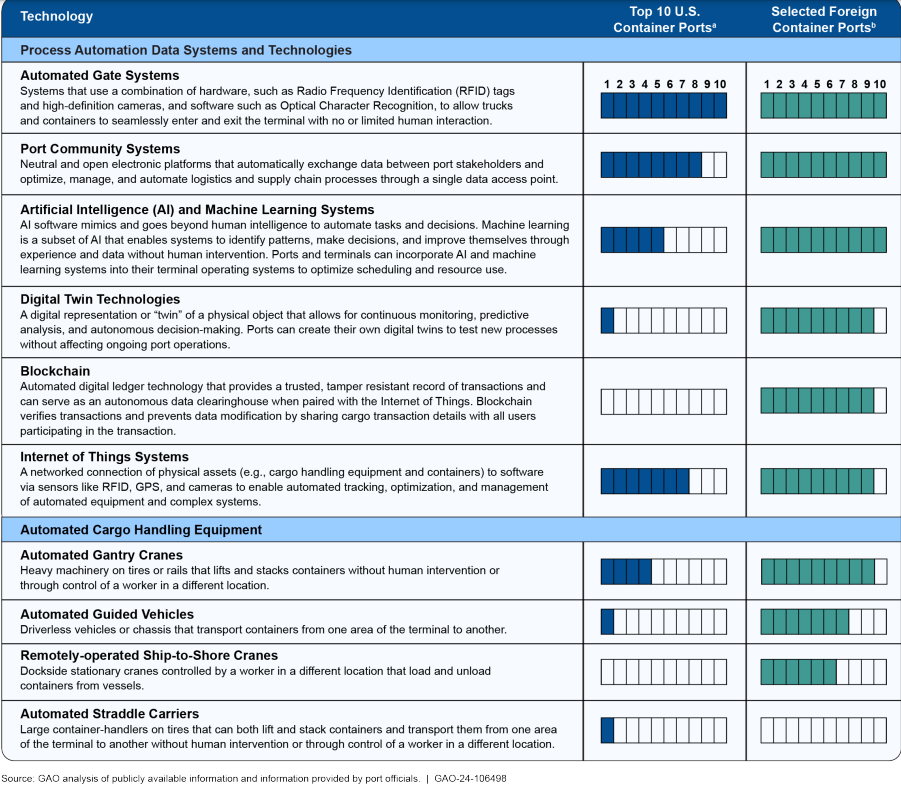

According to a recent report by the United States Government Accountability Office (GAO), automation technologies in the US ports offer potential benefits, particularly in improving worker safety and reducing emissions through greater operational efficiency. However, the report notes that the impact on other factors, such as the workforce, security, and overall port performance, has been mixed.

Among the largest US container ports, automation has been adopted to varying degrees. All 10 of the ports included in the GAO review have integrated at least one type of automation technology. However, the level and type of automation differ from port to port. The review found that more US ports have implemented process automation technologies, such as automated gate systems or terminal management software, than automated cargo handling equipment. Every terminal in these 10 ports uses some form of process automation, but only four ports have adopted automated cargo handling equipment like automated cranes or yard trucks.

Interestingly, US ports lag behind many international ports in adopting more advanced technologies like digital twin systems and blockchain. By contrast, many foreign ports have embraced these innovations more quickly, which highlights a gap in technological advancement between US and international ports.

One significant barrier to the broader adoption of automation in the ports is cost. For some operators, these costs may be prohibitive, especially in the absence of immediate or clear financial gains. US ports are gradually adopting automation, but they face significant challenges, especially in comparison to their international counterparts, which are quicker to embrace more advanced technologies.

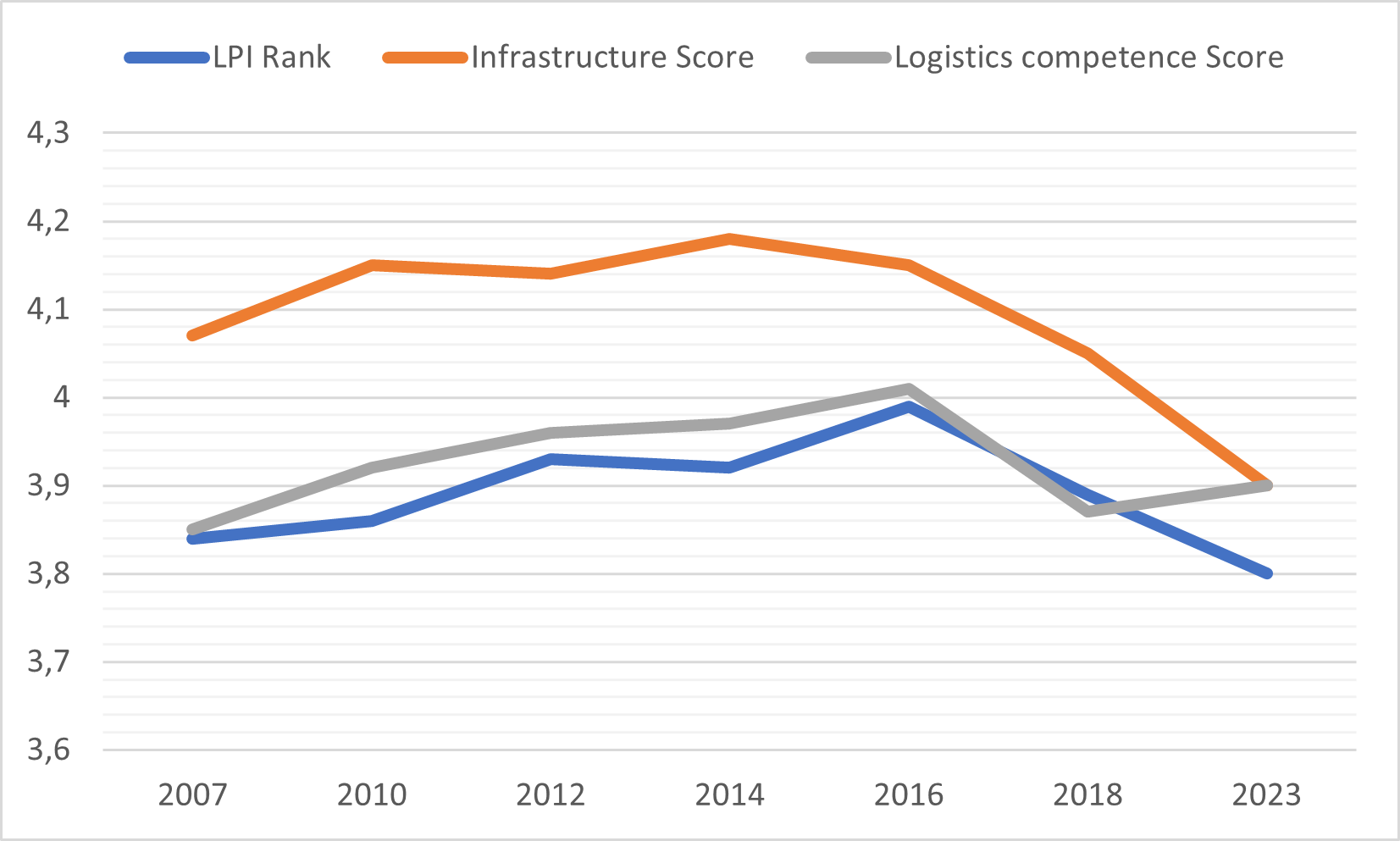

Container News conducted a further analysis, correlating some key indicators in order to extract more comprehensive conclusions about the overall performance of the US ports in terms of AI technologies adoption.

According to the Logistics Performance Index (LPI), the United States has experienced a decline in its overall score since 2016. Furthermore, the US logistics competence score also experienced a decline starting in 2016, but unlike the infrastructure score, it managed to stabilize after 2018. This stabilization may indicate that, while there were initial struggles with logistics service providers’ efficiency and skills, efforts have been made to address the issue.

The declining trends in the LPI and the challenges of automation adoption in US ports are closely related. The underinvestment in infrastructure since 2014 is likely a major contributor to the overall decline in logistics performance. The mixed effects of automation on US port performance also resonate with the challenges reflected in the LPI. This situation is reflected in the stabilizing logistics competence score: US logistics providers have managed to maintain a certain level of performance, but they have not advanced enough to improve their competitive standing. Without significant advancements in port automation and broader logistics innovation, the US risks falling further behind in global rankings.