Sea-Intelligence analysis shows that during the pandemic period, a mix of high demand and loss of capacity due to vessel congestion resulted in record vessel usage rates, which in turn resulted in a rise in spot rates, both of which peaked in February 2022.

However, vessel utilisation has fallen significantly since then; in the case of the Transpacific, it has now returned to pre-pandemic levels, whereas in the case of Asia-Europe, it initially fell below pre-pandemic figures but has now returned to pre-pandemic levels.

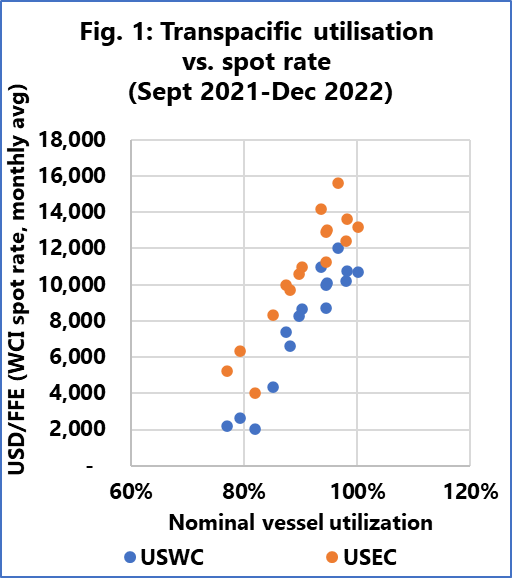

According to Sea-Intelligence, depending on whether utilisation is growing or declining, the dynamic between utilisation and market rates changes. When Transpacific utilisation was rising, spot rates stayed largely constant at a low level until a trigger point of around 90% nominal vessel utilisation caused a sharp rise in spot rates.

“When utilisation levels started to decrease since the peak in February 2022, we see a much more linear relationship between utilisation and spot rates, as illustrated in Figure 1 for the Transpacific trade,” said Alan Murphy, CEO of Sea-Intelligence.

Murphy went on to explain, “We see the same general pattern for Asia-Europe, although with a bit more noise. Overall, the rate developments in the Transpacific and Asia-Europe trades match expectations very well, if the assumption is a market operating with a close link between supply, demand, and pricing.”

However, as Sea-Intelligence data shows, there appears to be no obvious link between utilisation and spot rate levels in Transatlantic traffic. Unlike the Transpacific and Asia-Europe trades, falling utilisation levels have so far had no effect on trade pricing, suggesting that another mechanism must be at work in setting rate levels for this particular trade.