In March 2023, the rate of contraction for laden imports across the major North American West Coast (NAWC) ports decreased on an annualised basis compared to 2019.

“While this could very well be a temporary easing up, it could also be an indication of normalising market conditions,” stated Alan Murphy, CEO of Sea-Intelligence.

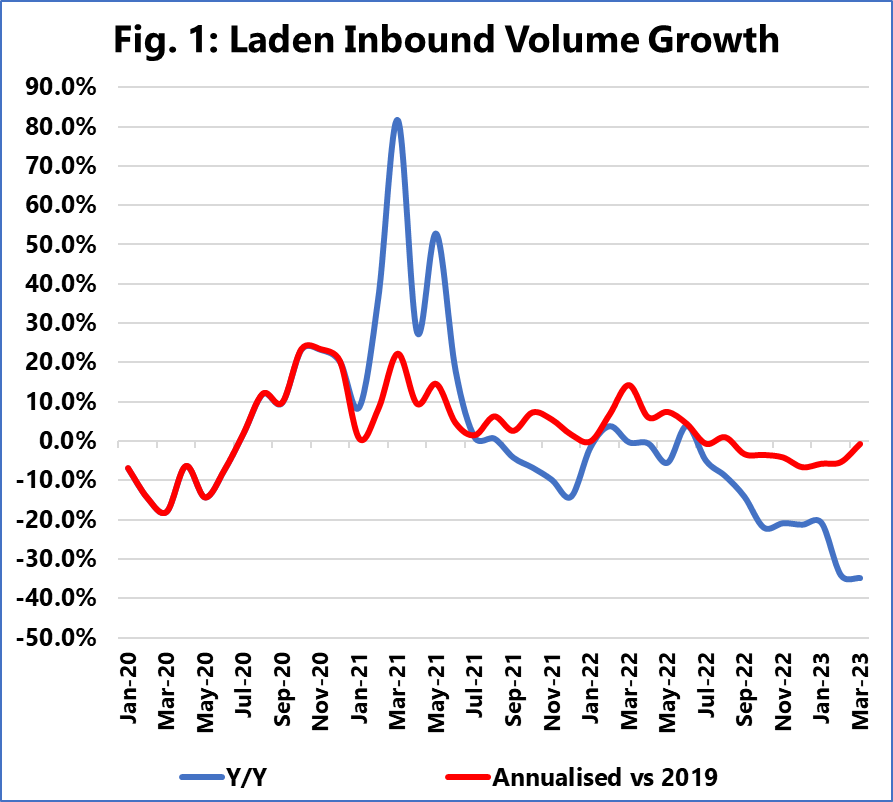

The following figure depicts the increase in laden incoming volume from January 2020 to March 2023.

Alan Murphy explained that even if the Y/Y growth (blue line) looks very bad in terms of a substantial volume contraction, clients have to keep in mind that due to the volatile nature of demand in the last two years, a Y/Y comparison will inadvertently lead to a distorted analysis, as the relatively high demand growth in the same months in 2022 would mean that any growth under that level, even if it is in line with the pre-Covid baseline, would seem like a significant volume contraction.

This is why Sea-Intelligence includes the annualised figure, which reveals that the contraction for laden imports was rather consistent in January and February 2023, at roughly -5.5%, with the March figure improving to -0.7%.

A similar pattern can be seen for total handled volumes, with a peak contraction of -5.0% in February 2023, followed by an upturn in March, when the contraction eased up to -2.2%.

“As mentioned at the start, this could be temporary, or it could also be an indication that we are heading towards market normalisation,” said Murphy.

What is more alarming, according to the Sea-Intelligence analysis, is that while empty exports have begun to fall, the rate of contraction for laden exports has not slowed. The most possible reason is that these volumes are being exported via the East Coast, perhaps resulting in volume losses for the West Coast.