This article explores recent trends in stock performance within the container shipping industry, focusing on notable fluctuations among major ocean carriers over the past week, spanning late September to early October.

In the following section, we will examine the stock trends of some of the world’s largest shipping companies, offering an in-depth look at their market performance during this period.

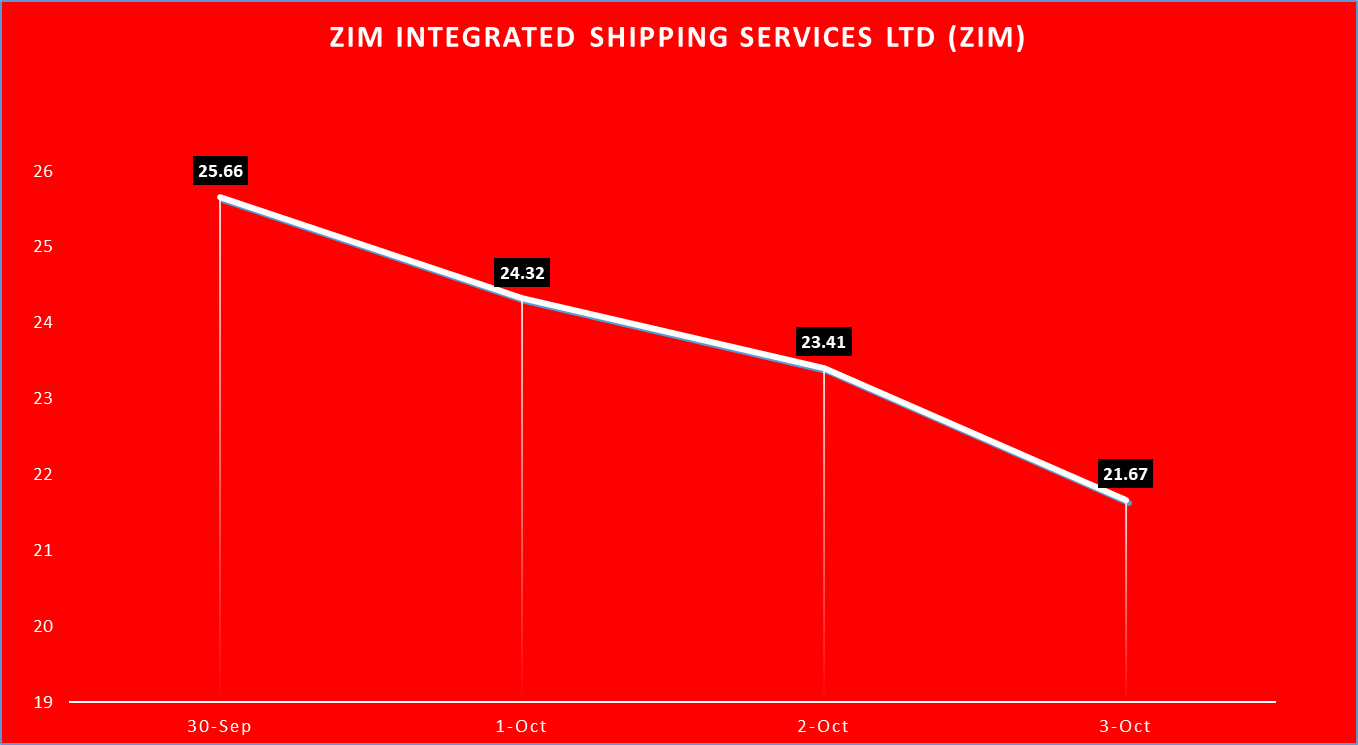

- ZIM Integrated Shipping Services Ltd (ZIM)

USD

USD

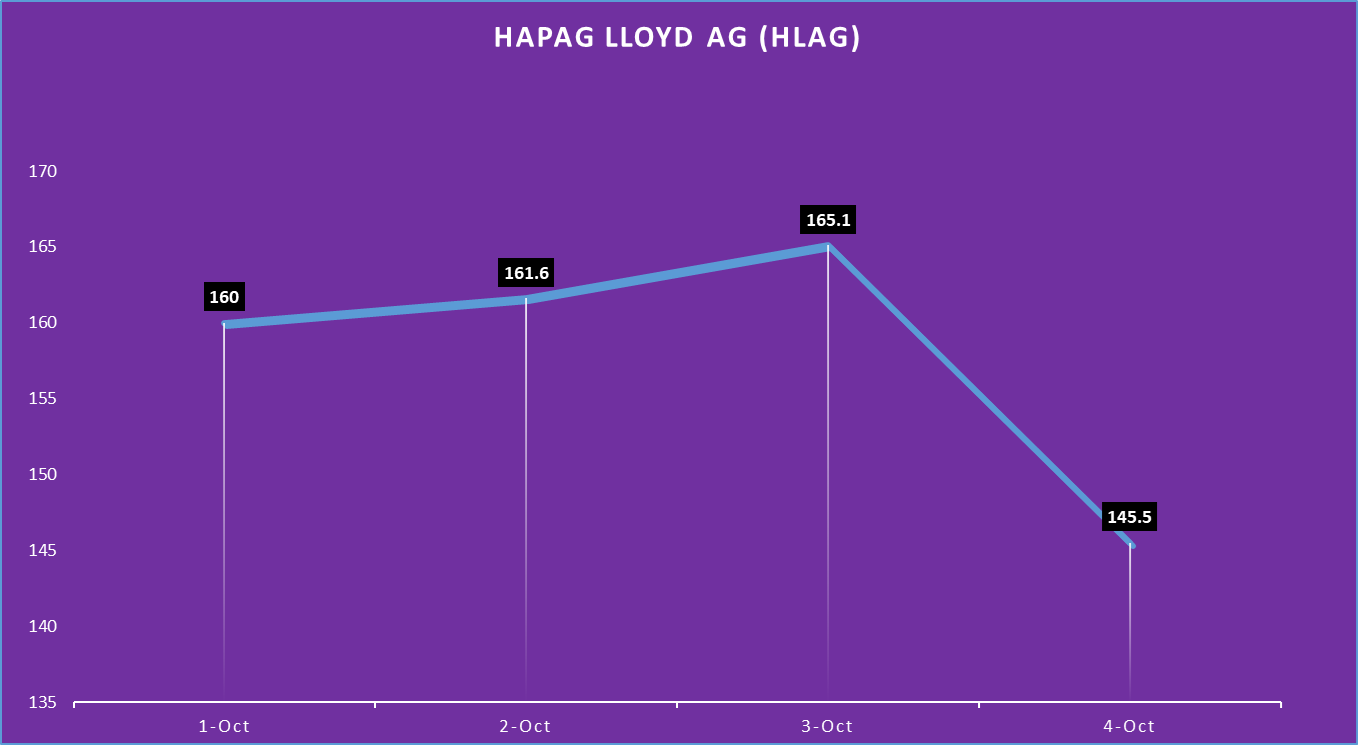

- Hapag-Lloyd AG

EUR

EUR

The stock performance for Hapag-Lloyd AG from October 1 to October 4 shows both gains and a sharp decline. Starting at €160 on October 1, the stock increased slightly to €161.6 on October 2, followed by a further rise to €165.1 on October 3. However, by October 4, the stock experienced a steep drop of 11.9%, falling to €145.5. This represents a significant reversal after initial growth during the period.

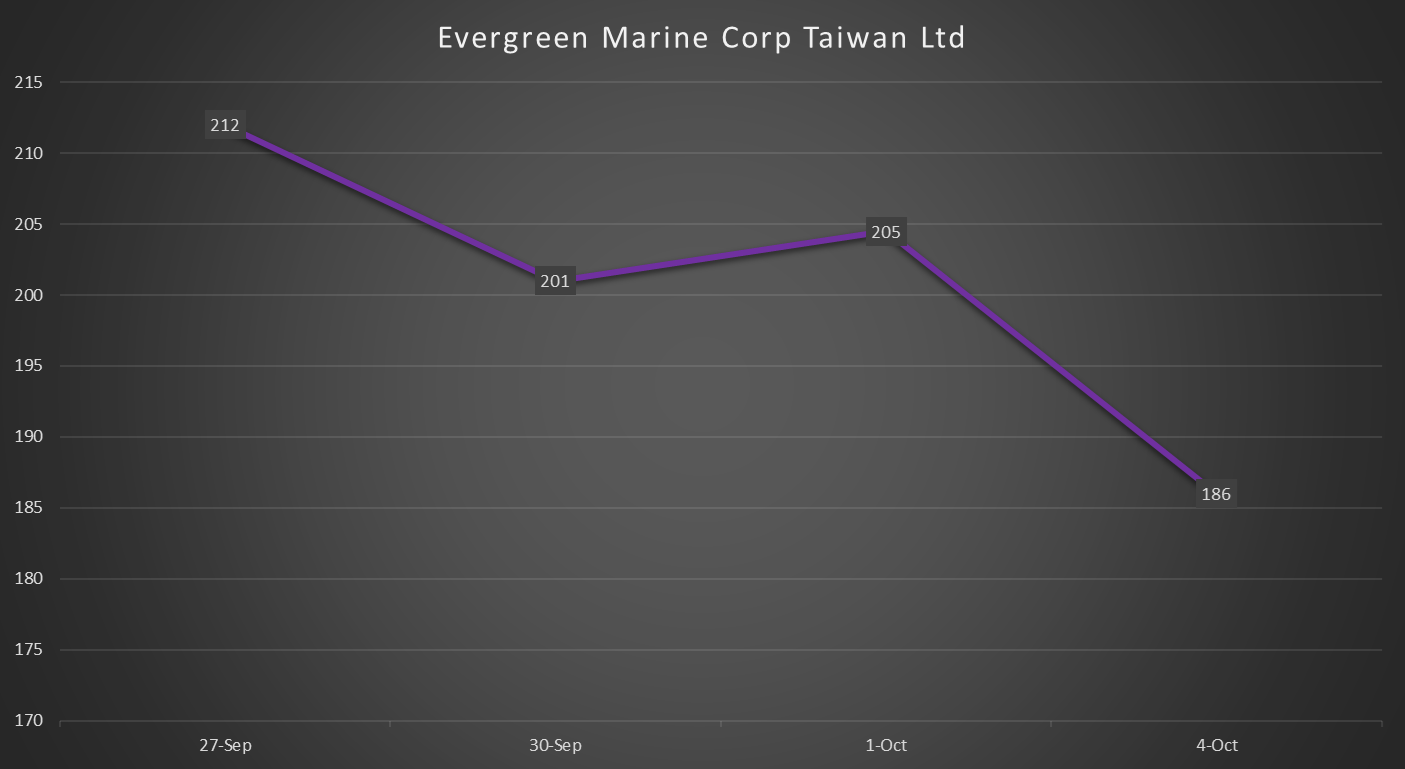

- Evergreen Marine Corp Taiwan Ltd

TWD

TWD

The stock performance for Evergreen Marine Corp Taiwan Ltd from September 27 to October 4 reflects a general downward trend. Starting at TWD212 on September 27, the stock fell to TWD201 by September 30. Although it experienced a slight rebound to TWD205 on October 1, it then saw a substantial decline of 9.2% to TWD186 on October 4. This results in an overall decrease of approximately 12.3% during the period, highlighting increased volatility in the stock.

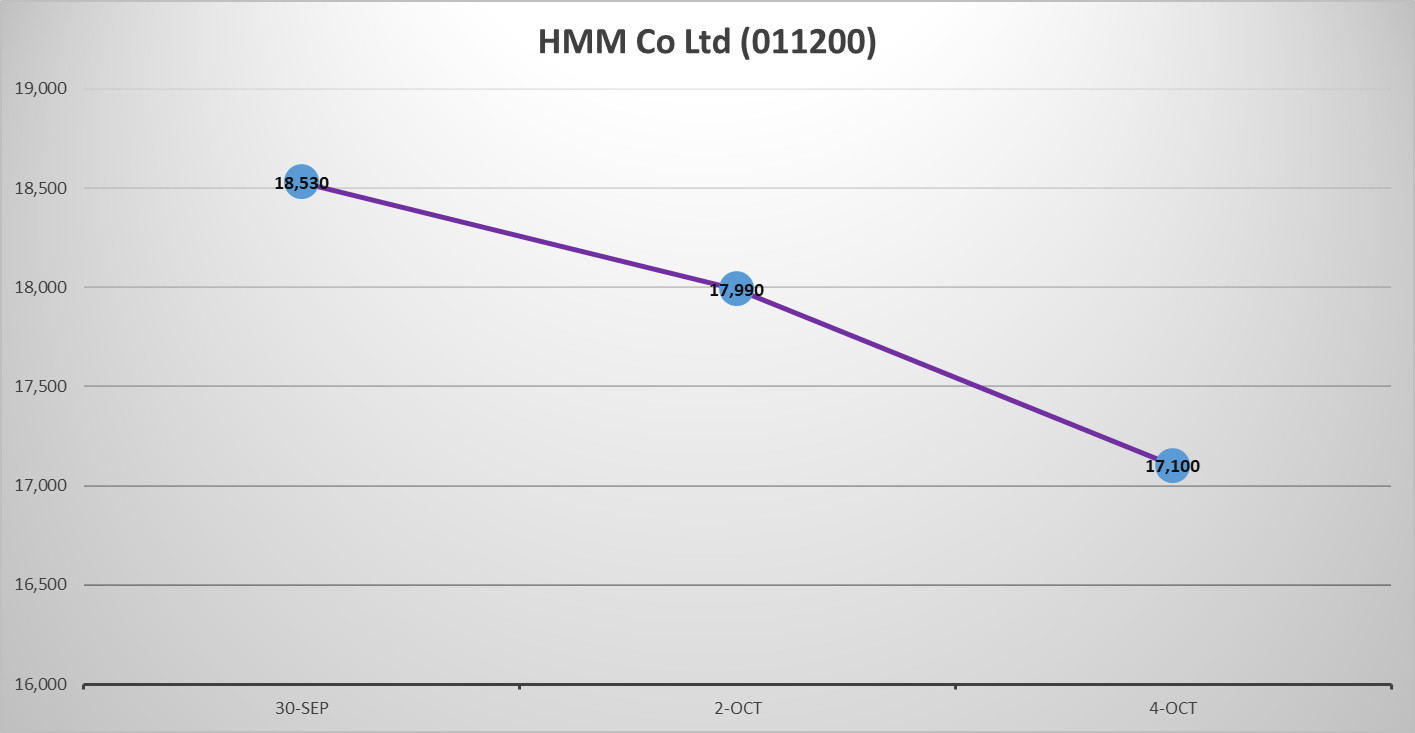

- HMM Co Ltd

KRW

KRW

In the early days of October, HMM Co Ltd experienced a noticeable decline in its stock prices. On September 30th, the stock was valued at KRW18,530. However, by October 2nd, it had decreased to KRW17,990, indicating a slight drop. This downward trend continued as the stock price fell further to KRW17,100 by October 4th. Such movements suggest market volatility and might prompt investors to closely monitor future performance and any underlying factors contributing to these changes.

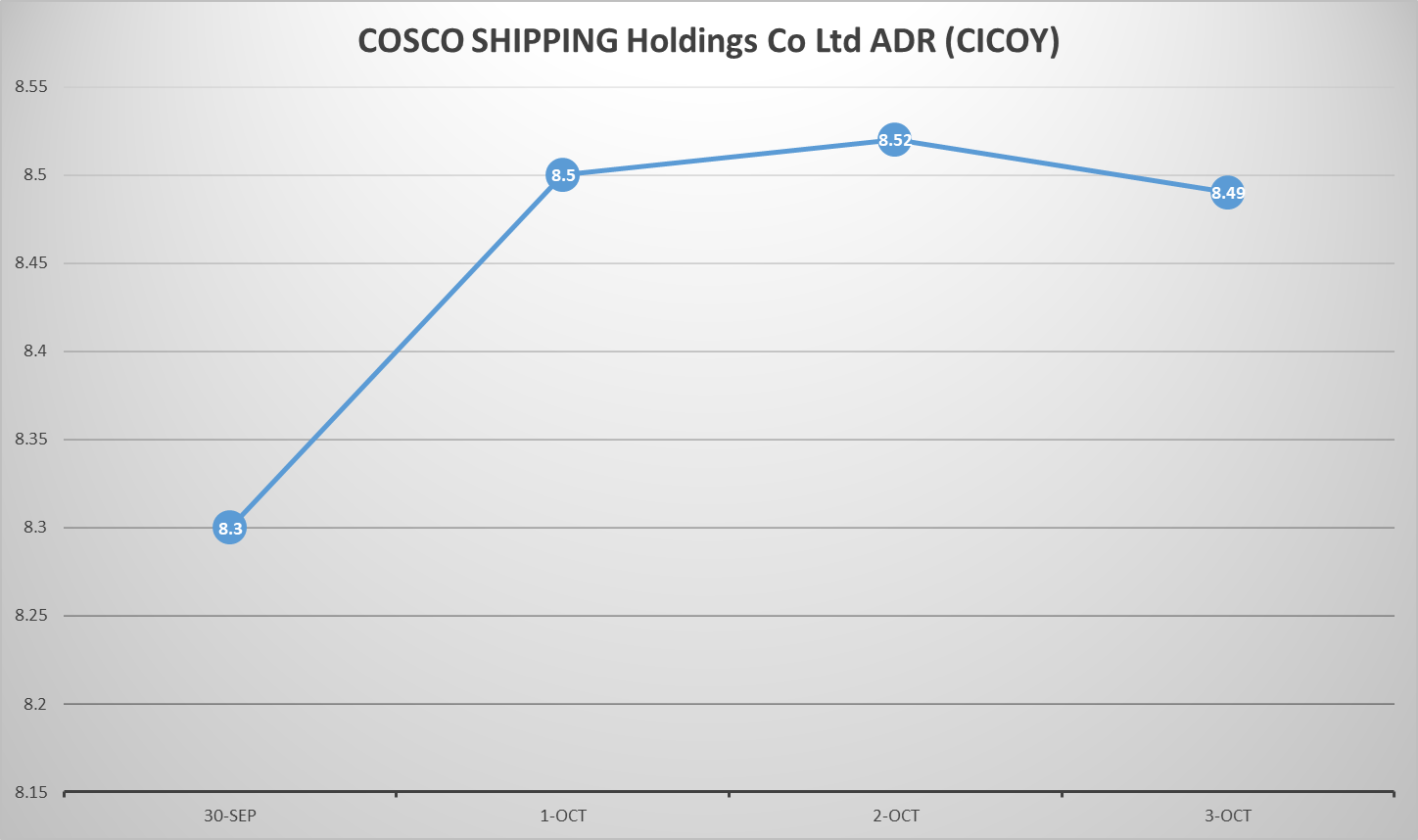

- COSCO SHIPPING Holdings Co Ltd ADR (CICOY)

USD

USD

In the early days of October, COSCO SHIPPING Holdings Co Ltd ADR (CICOY) experienced a modest upward trend in its stock prices. On September 30th, the stock closed at $8.30, and by October 1st, it had risen to $8.50. The increase continued slightly on October 2nd, reaching $8.52, before experiencing a minor dip to $8.49 on October 3rd. This fluctuation illustrates a period of relative stability with a slight increase in investor confidence.

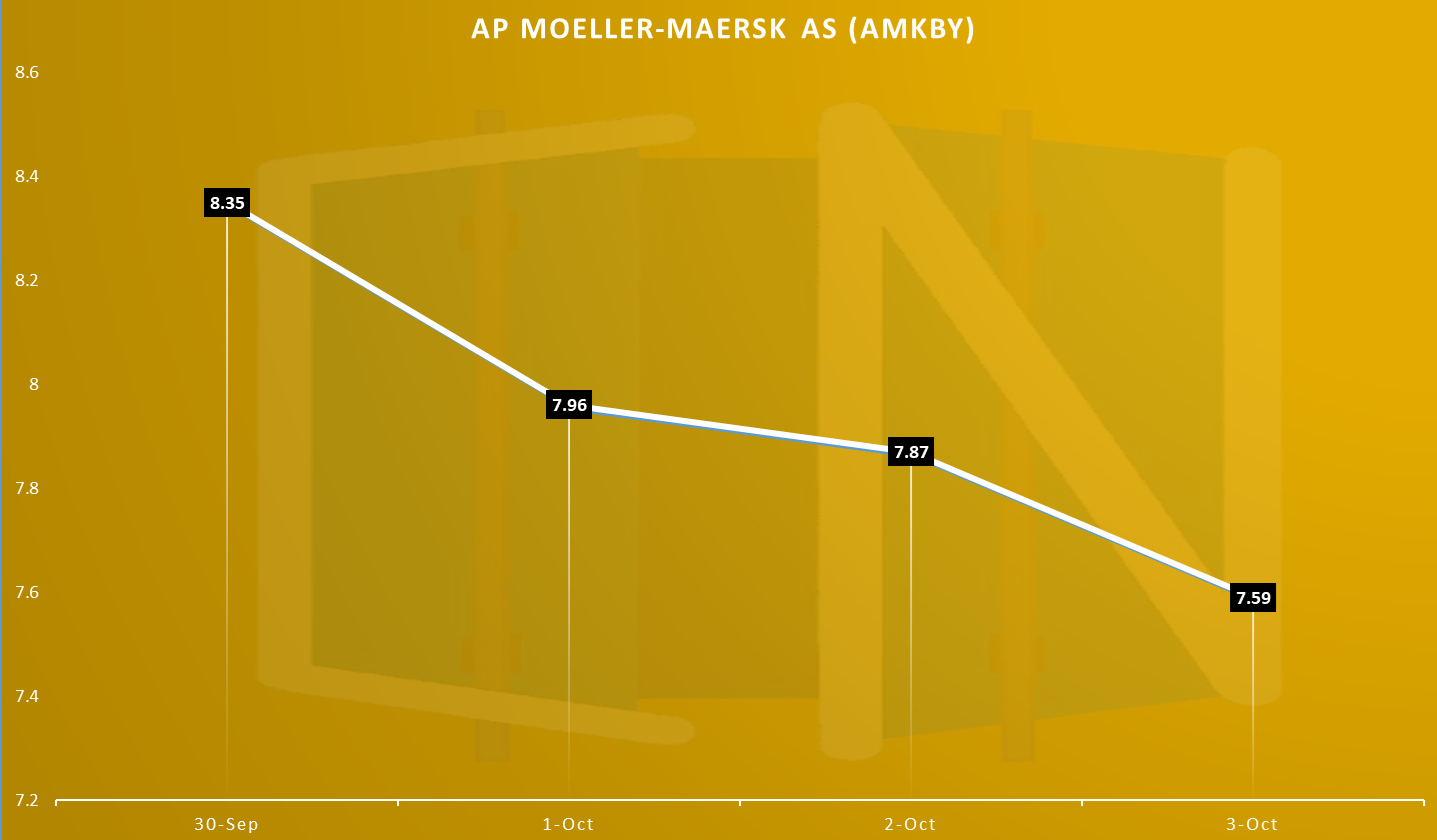

- AP Moeller-Maersk AS (AMKBY)

USD

USD

In early October, the stock prices for AP Moeller-Maersk AS (AMKBY) experienced a notable decline. On September 30th, the stock was priced at $8.35, but by October 1st, it had dropped to $7.96. This downward trend continued as the price further decreased to $7.87 on October 2nd and reached $7.59 by October 3rd. The consistent drop in stock prices over these few days suggests a period of volatility or market adjustment for the company.

The recent stock performances in the container shipping sector from late September to early October reveal a trend of volatility and declines. Many stocks initially experienced upward movements but ultimately faced significant downturns.

Overall, the sector reflects a complex landscape marked by short-term recoveries followed by substantial corrections, indicating ongoing challenges amidst fluctuating market conditions. This volatility underscores the sensitive nature of the industry in response to external factors affecting demand and investor sentiment.

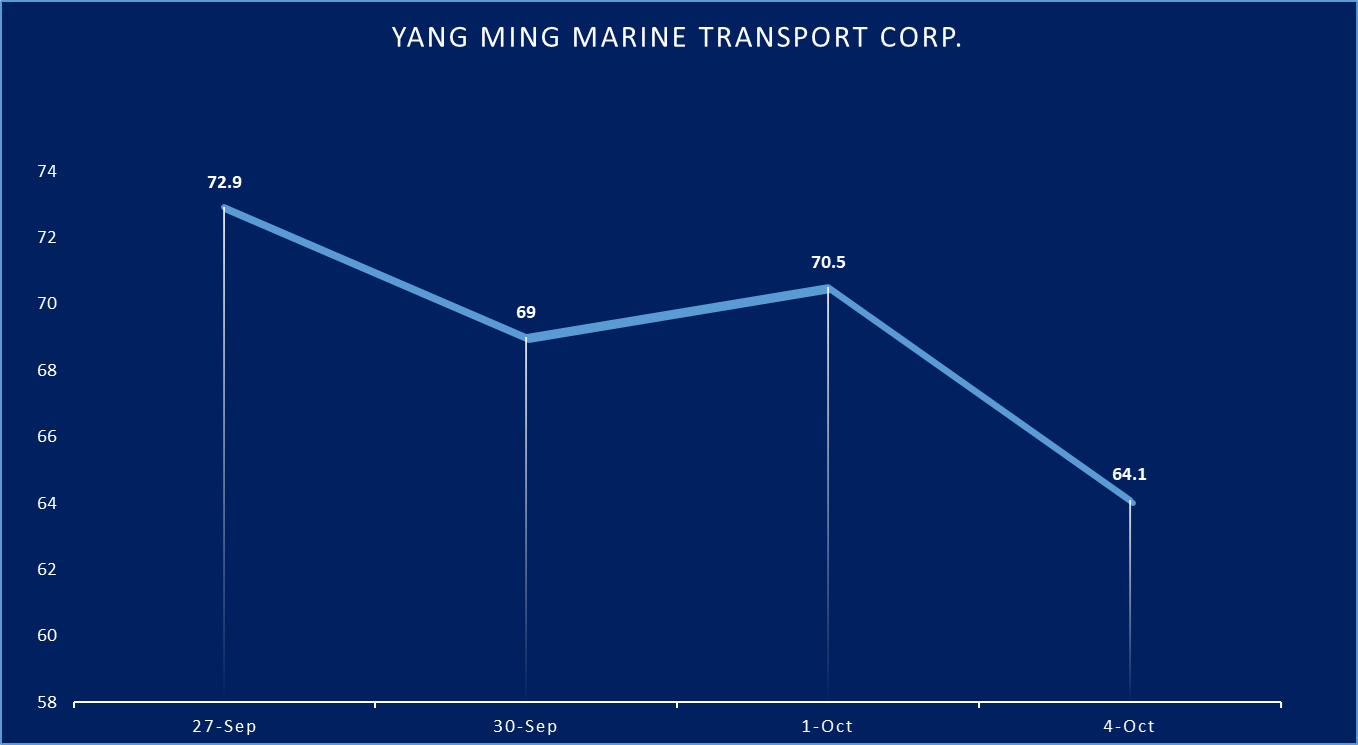

TWD

TWD