The container shipping industry continues to navigate a complex and ever-evolving landscape, shaped by shifting economic conditions, geopolitical tensions, and supply chain disruptions. Over the past week, stock prices across major shipping companies have reflected a mix of resilience and volatility, influenced by factors ranging from Red Sea security threats to fluctuating global trade demand.

As freight rates remain elevated and rerouted shipping lanes reshape the industry’s cost structures, investors are closely watching how companies adapt to these challenges. With economic uncertainties still lingering, the balance between short-term gains and long-term stability remains a critical focal point for the industry.

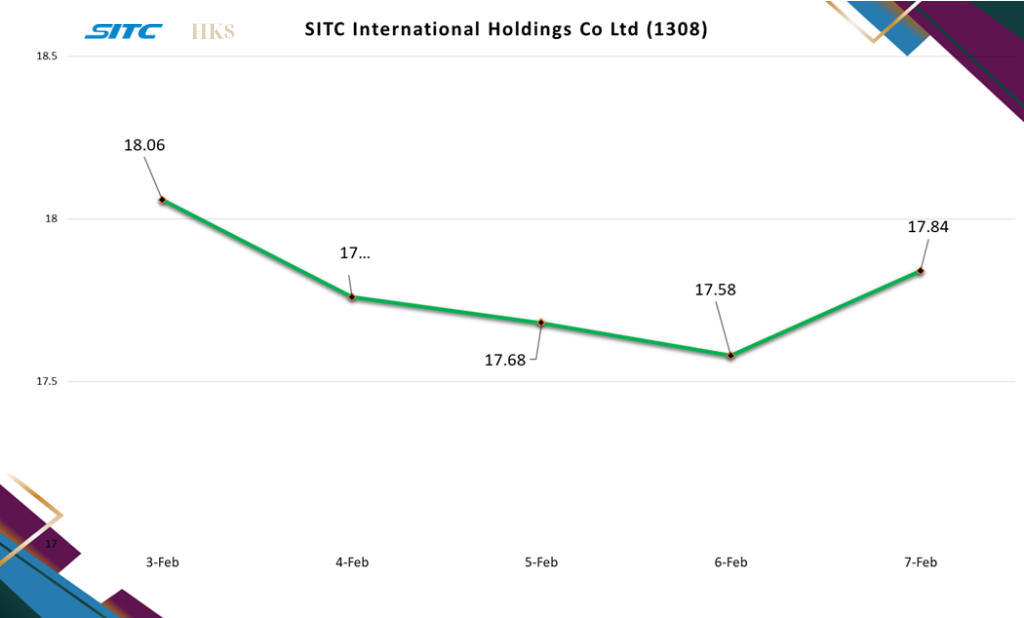

- SITC International Holdings Co Ltd (1308)

SITC International saw relatively stable movement over the past week, fluctuating between HK$ 17.58 and HK$ 18.06. The minor dips and recoveries suggest cautious market sentiment, likely influenced by broader trade conditions in Asia. Given SITC’s heavy reliance on intra-Asia trade, any disruptions in regional supply chains—whether due to ongoing geopolitical tensions in the South China Sea or shifts in manufacturing trends—could be weighing on investor confidence.

The lack of any strong upward momentum might also reflect concerns over Chinese export demand, especially amid sluggish post-pandemic recovery and tighter consumer spending worldwide.

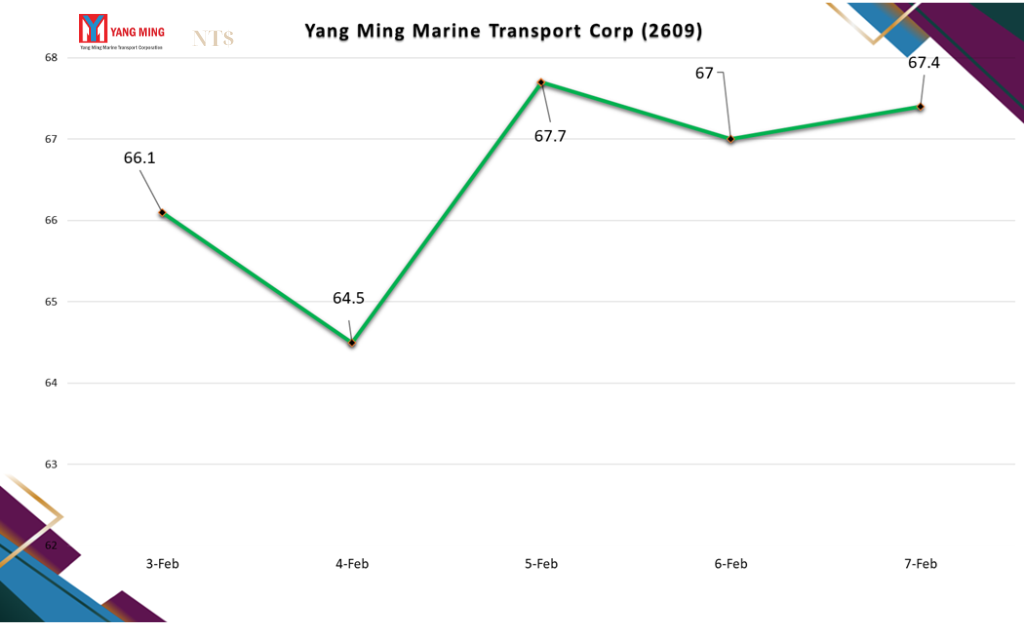

- Yang Ming Marine Transport Corp (2609)

Yang Ming’s stock prices saw moderate fluctuation, with a notable drop midweek to NT$ 64.5 before recovering to NT$ 67.7 This movement suggests a mix of short-term volatility and investor repositioning. The Taiwanese shipping giant, like its peers, remains sensitive to global trade dynamics, including the lingering effects of U.S. tariffs on Chinese goods and shifting freight demand patterns.

The ongoing Red Sea tensions, where Houthi attacks have forced reroutings of major shipping lines, may have also contributed to stock movement, as higher costs and longer transit times reshape carrier profitability. A stabilizing demand outlook from the U.S. and Europe, however, may provide some optimism for Yang Ming moving forward.

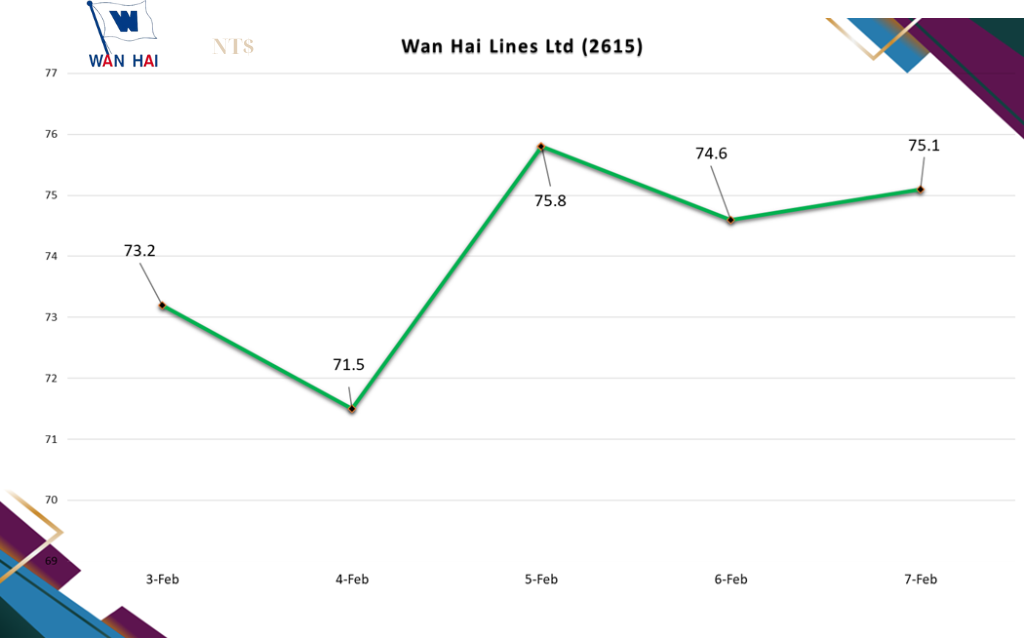

- Wan Hai Lines Ltd (2615)

Wan Hai Lines exhibited an interesting price trajectory, dropping to NT$ 71.5 before rebounding to NT$ 75.8 and settling around NT$ 75.1 This pattern may reflect short-term speculation as investors react to global shipping trends. Unlike its larger competitors, Wan Hai has a strong exposure to regional container shipping, making it more sensitive to Asia’s economic conditions.

With China’s export slowdown and manufacturing sector uncertainties, traders might be adjusting positions accordingly. However, rising freight rates due to supply chain bottlenecks and re-routings—especially with continued Red Sea tensions—could bolster Wan Hai’s revenue outlook in the near term.

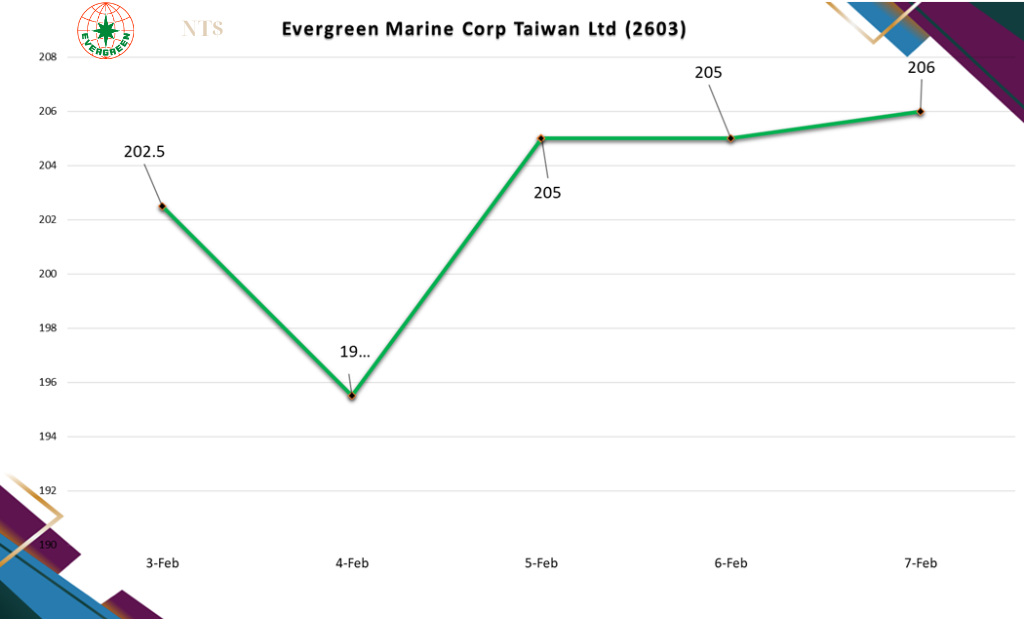

- Evergreen Marine Corp Taiwan Ltd (2603)

Evergreen Marine showed strong resilience, fluctuating between NT$ 195.50 and NT$ 206. The slight dip midweek was quickly recovered, suggesting solid investor confidence despite market headwinds. A key factor supporting Evergreen’s outlook is its global reach, which allows it to capitalize on disruptions affecting smaller players.

The recent spike in trans-Pacific freight rates, driven by shipping delays and increased demand, may have provided additional support. However, with China’s manufacturing recovery still uncertain and global interest rate policies affecting trade volumes, Evergreen will need to navigate a complex economic landscape in the months ahead.

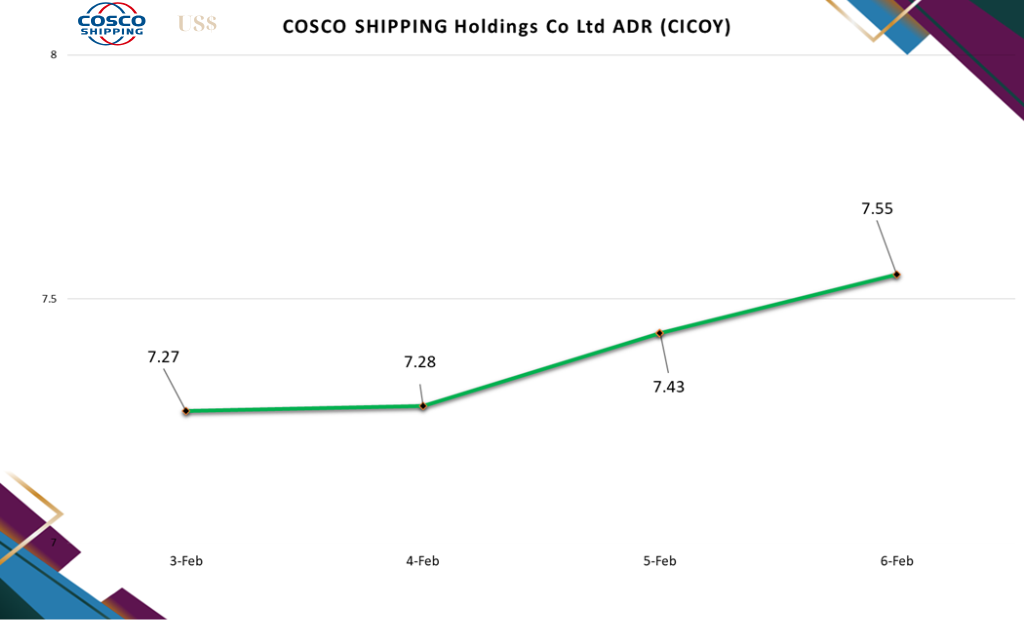

- COSCO SHIPPING Holdings Co Ltd ADR (CICOY)

COSCO’s stock price moved steadily upwards, reaching US$ 7.55 from US$ 7.27 earlier in the week. This gradual climb could be linked to improving sentiment around China’s export market, despite ongoing global trade uncertainties.

As a major player in China’s state-backed shipping industry, COSCO remains sensitive to Beijing’s trade policies and economic stimulus efforts. Additionally, geopolitical shifts—such as China’s increasing maritime presence in the South China Sea—may contribute to investor caution, but rising freight rates could continue to provide upward momentum in the short term.

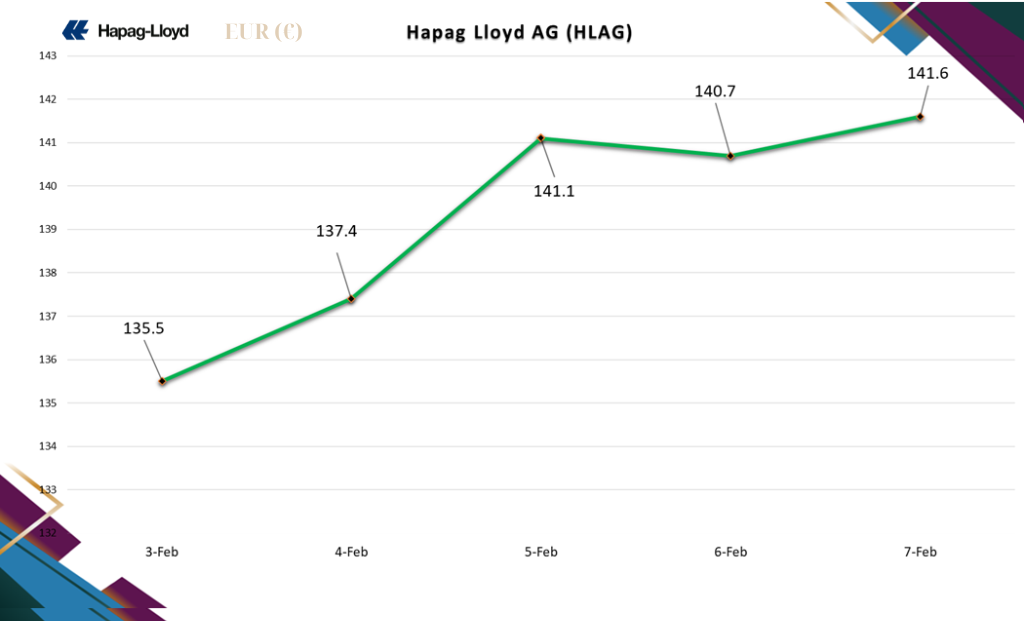

- Hapag Lloyd AG (HLAG)

Hapag-Lloyd’s stock climbed from € 135.5 to € 141.6, showing resilience amid fluctuating shipping rates. The German carrier, a key player in the European and transatlantic trade routes, likely benefited from increasing demand in North America and Europe, along with continued supply chain disruptions forcing higher freight costs.

However, with inflation concerns still looming over European economies and potential shifts in consumer spending, Hapag-Lloyd’s growth trajectory may face some turbulence ahead. Additionally, reroutings due to the Red Sea crisis are keeping shipping costs elevated, a factor that could both benefit and challenge operations.

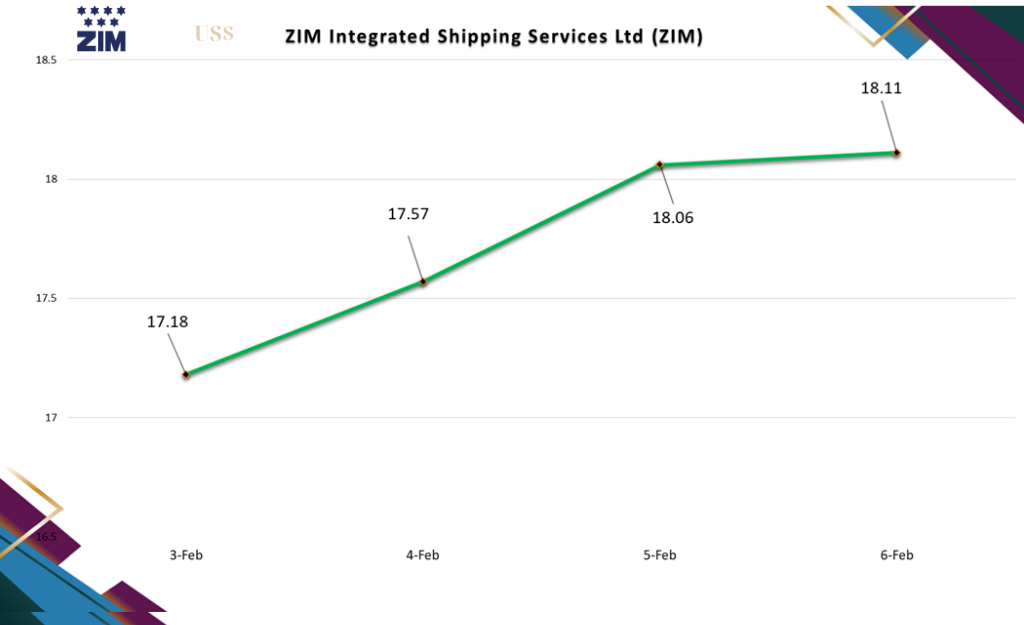

- ZIM Integrated Shipping Services Ltd (ZIM)

ZIM’s stock price made notable gains, moving from US$ 17.18 to US$ 18.11, reflecting investor optimism amid shifting global trade patterns. The Israeli shipping company remains heavily exposed to geopolitical risks, particularly in the Middle East. The recent Red Sea attacks by Houthi rebels have heightened tensions, affecting shipping routes and pushing freight rates higher—a trend that could bolster ZIM’s revenues in the near term.

However, ongoing global economic uncertainty and higher operational costs could put pressure on profitability, making the company’s outlook more volatile than its competitors.

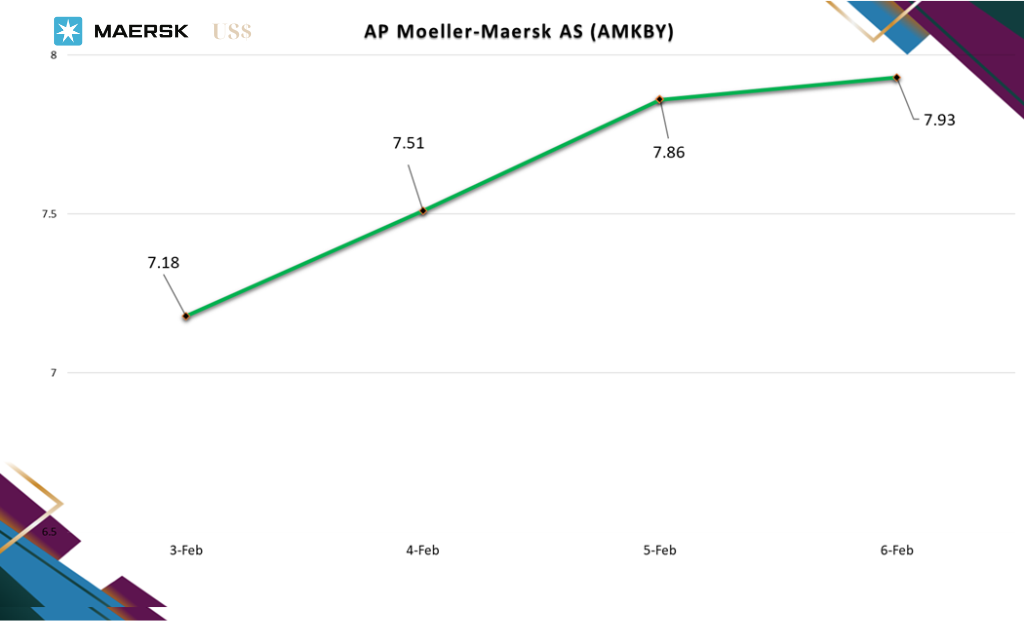

- AP Moeller-Maersk AS (AMKBY)

Maersk saw a steady climb, reaching US$ 7.93 from US$ 7.18, possibly driven by strong demand for its logistics services and supply chain disruptions benefiting freight rates. As one of the world’s largest shipping firms, Maersk is deeply impacted by global economic conditions, including sluggish Chinese exports and U.S. trade policies.

The company’s ongoing strategic shift towards integrated logistics solutions could be a long-term value driver, but near-term volatility remains a concern, especially with fuel costs rising due to geopolitical instability.

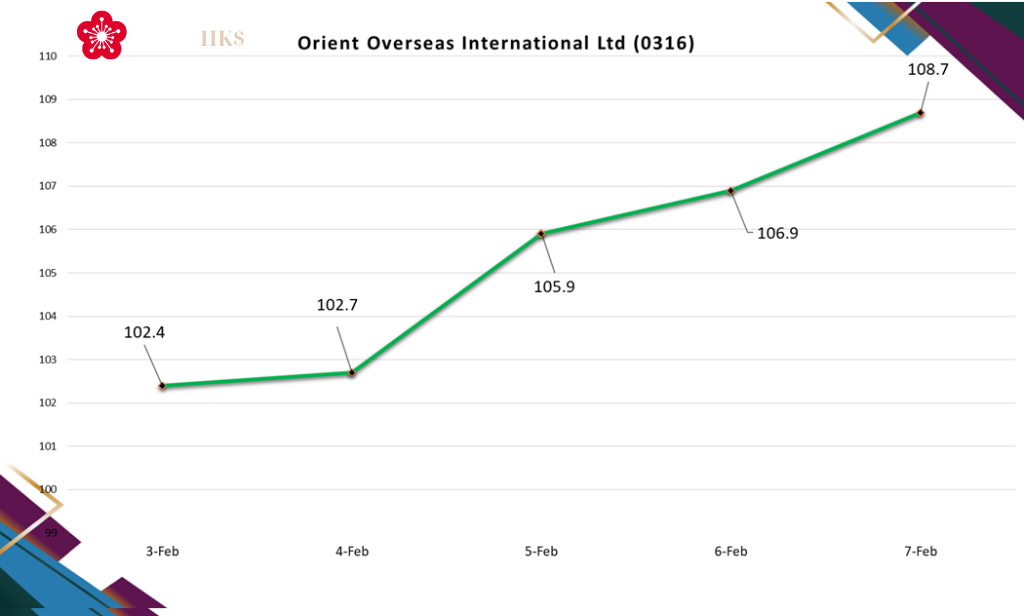

- Orient Overseas International Ltd (0316)

Orient Overseas’ stock price made a healthy jump from HK$ 102.4 to HK$ 108.7, reflecting growing investor confidence. The company, a subsidiary of COSCO, benefits from strong ties to Chinese trade networks. Recent news of improving shipping demand, coupled with tightening supply due to rerouted vessels avoiding the Red Sea, may have contributed to this positive movement.

However, as global economic uncertainties persist, particularly in Europe and the U.S., further price volatility can’t be ruled out.

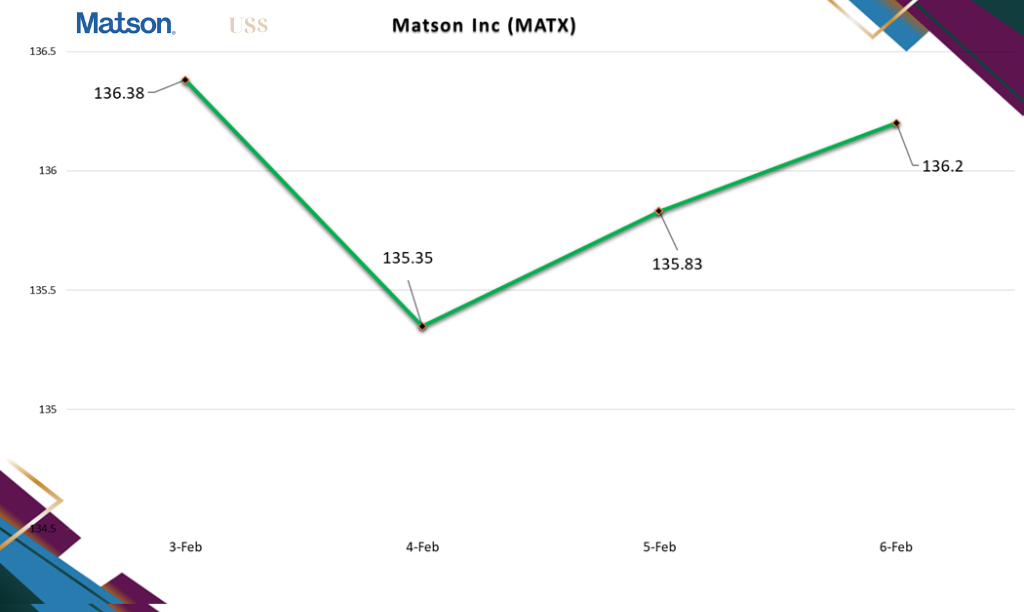

- Matson Inc (MATX)

Matson remained relatively stable, fluctuating slightly between US$ 135.35 and US$ 136.38. The company, which focuses on US domestic and Pacific shipping routes, is somewhat insulated from the broader global shipping turmoil. However, any slowdown in the U.S. economy could impact Matson’s trade volumes, especially if consumer spending weakens.

The firm’s steady performance suggests confidence in its market position, but investors may be watching fuel costs and labor conditions closely in the coming months.

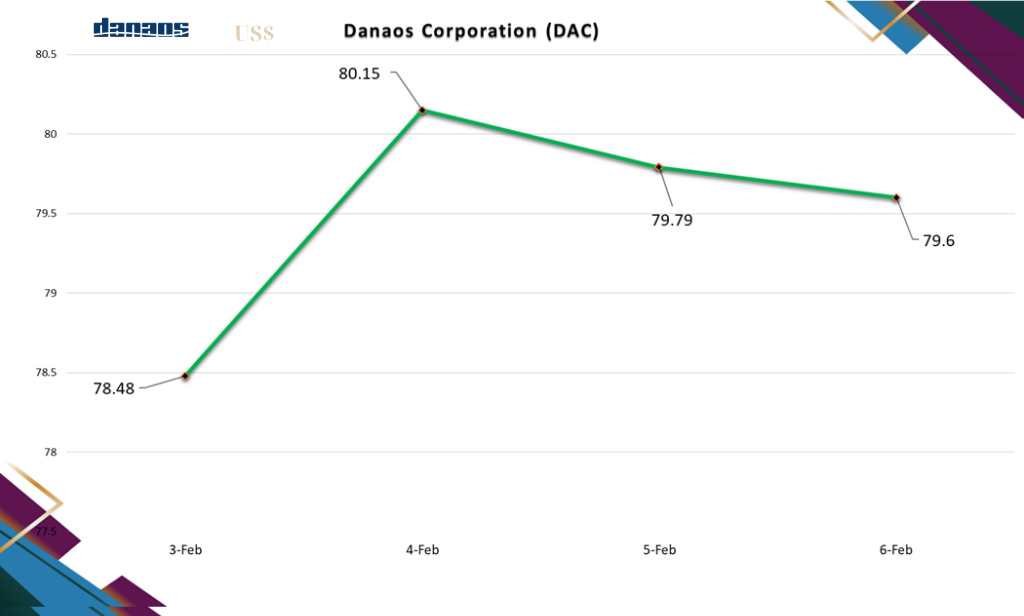

- Danaos Corporation (DAC)

Danaos’ stock oscillated between US$ 78.48 and US$ 80.15, reflecting a mix of cautious optimism and market rebalancing. As one of the largest independent containership lessors, Danaos benefits from long-term charter agreements, which help stabilize earnings despite shipping market volatility.

Rising demand for container vessels, fueled by congestion and reroutings, may be supporting its stock price. However, concerns over future charter rates and potential downturns in global trade remain factors to watch.

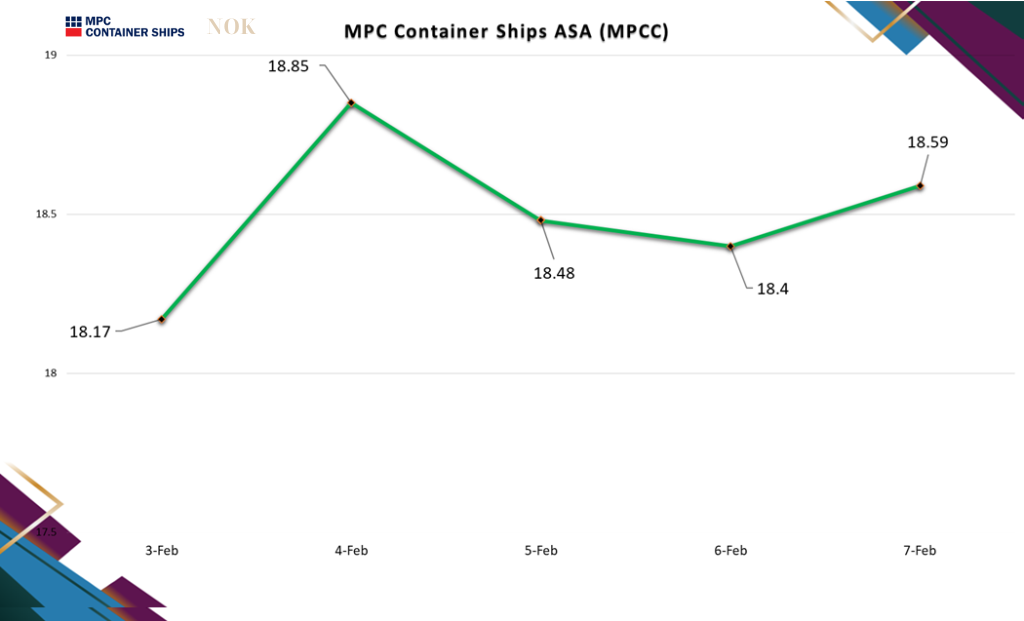

- MPC Container Ships ASA (MPCC)

MPC Container Ships showed mixed movement, rising to NOK 18.85 before settling around NOK 18.59. The stock’s slight fluctuation aligns with the broader container shipping sector, where higher freight rates are being balanced by lingering macroeconomic concerns.

As a specialized player in the smaller container ship segment, MPCC may see opportunities in regional routes that are less impacted by major global disruptions. However, with vessel operating costs rising, maintaining margins will be key.

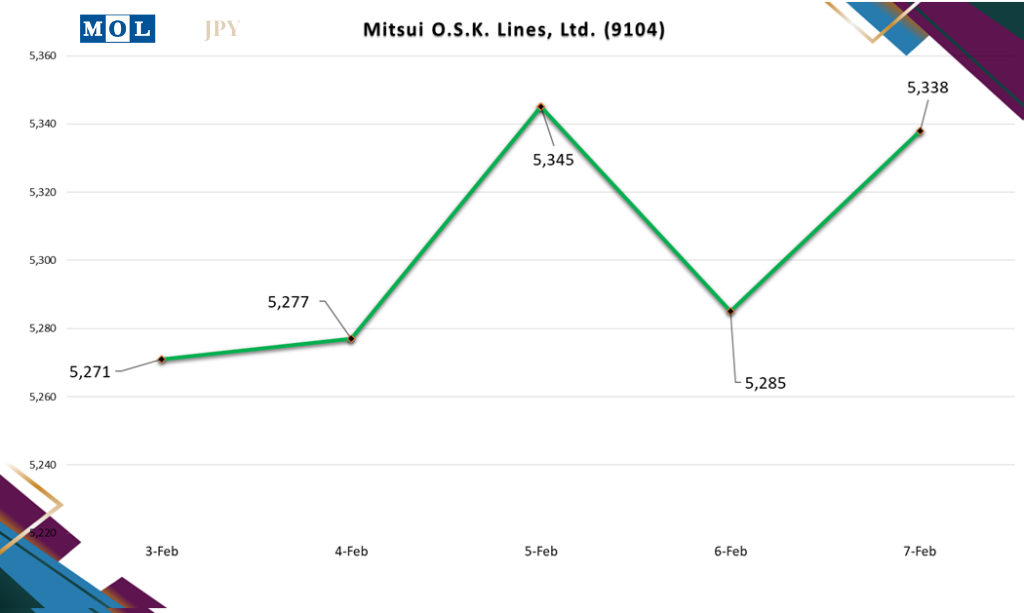

- Mitsui O.S.K. Lines, Ltd. (9104)

Mitsui O.S.K. Lines experienced steady growth, moving from ¥ 5,271 to ¥ 5,338 over the week. As one of Japan’s largest shipping companies, Mitsui is heavily influenced by Asian trade dynamics and global energy shipments.

The firm’s exposure to LNG transportation offers a hedge against container shipping volatility, which may be appealing to investors amid global energy uncertainty. Additionally, Japan’s economic policies and export trends will play a crucial role in determining its future stock performance.

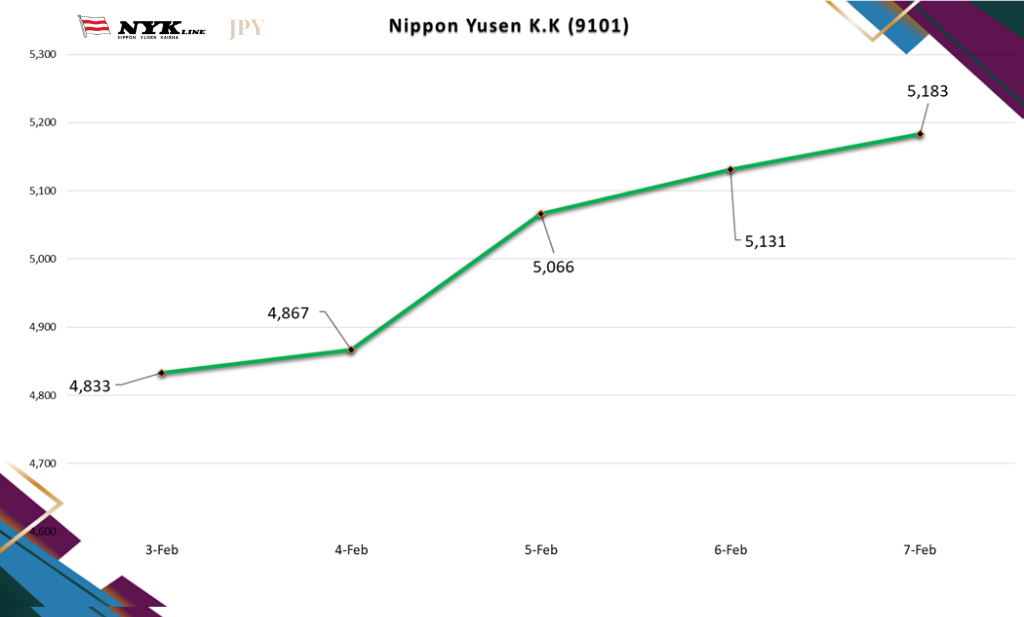

- Nippon Yusen K.K (9101)

Nippon Yusen’s stock experienced solid upward movement, rising from ¥ 4,833 to ¥ 5,183. As a diversified shipping company with interests in container, bulk, and energy transport, Nippon Yusen is well-positioned to navigate shifting global trade patterns.

The company’s involvement in LNG shipping could provide stability, especially as global energy demand remains volatile. Continued supply chain bottlenecks may keep container shipping revenues elevated, but macroeconomic pressures could influence future performance.

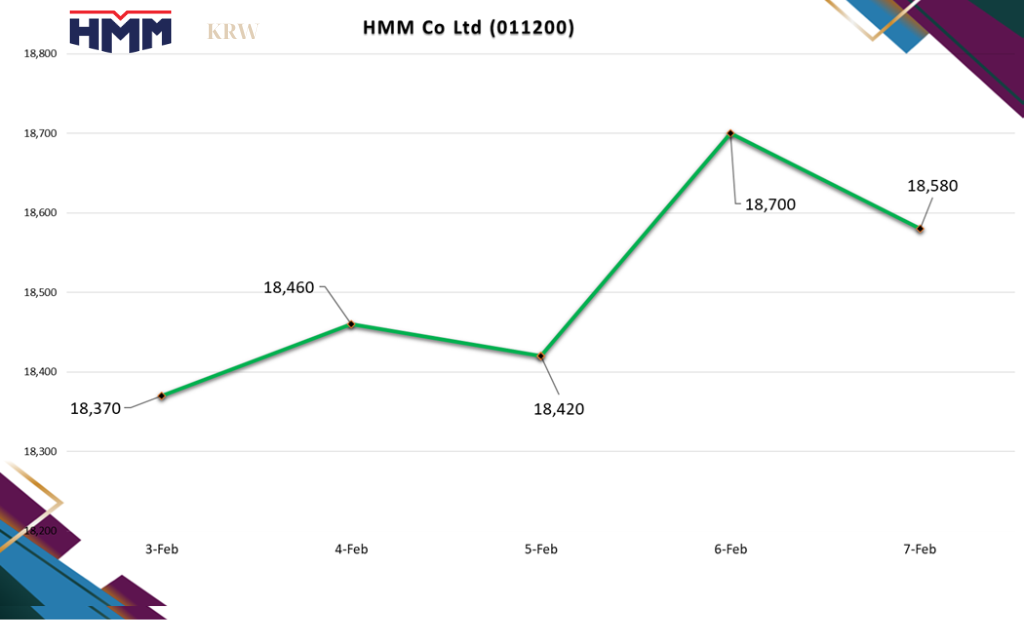

- HMM Co Ltd (011200)

HMM saw notable fluctuations, reaching a peak of KRW 18,700 before settling at KRW 18,580. The South Korean shipping giant continues to benefit from strong freight demand, particularly on Transpacific routes.

With increasing geopolitical risks and supply chain disruptions, HMM could maintain pricing power in the short term. However, concerns about declining consumer demand in the US and China’s slower-than-expected recovery could weigh on its stock in the longer term.

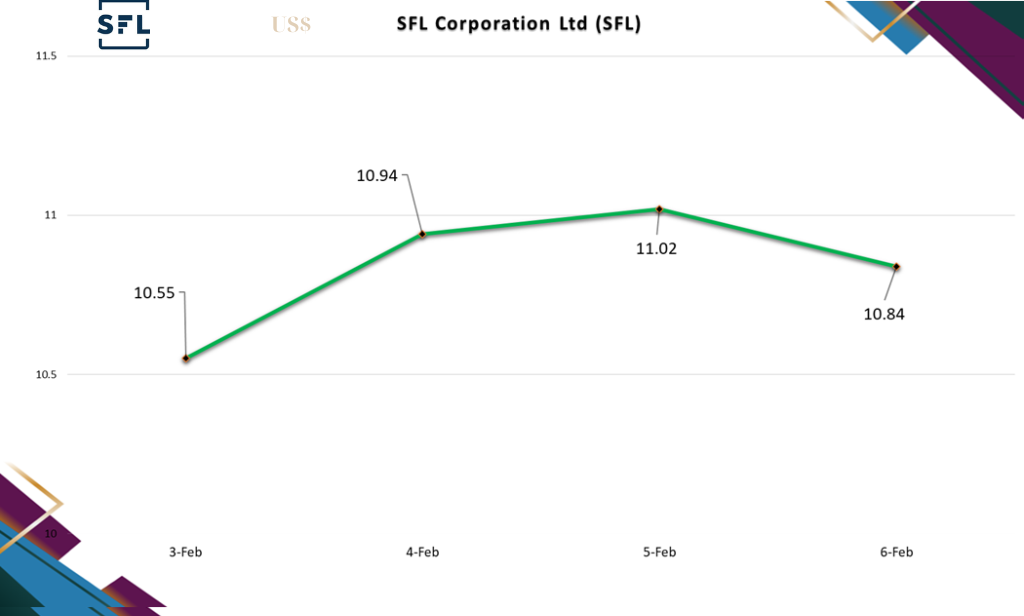

- SFL Corporation Ltd (SFL)

SFL Corporation showed a moderate rise to US$ 11.02 before dipping slightly to US$ 10.84. The company, which specializes in ship leasing, benefits from stable charter contracts. With increased demand for vessels due to longer shipping routes, SFL is in a strong position to maintain earnings.

However, fluctuations in oil prices and the broader economic climate could impact its leasing agreements and investor sentiment in the coming months.

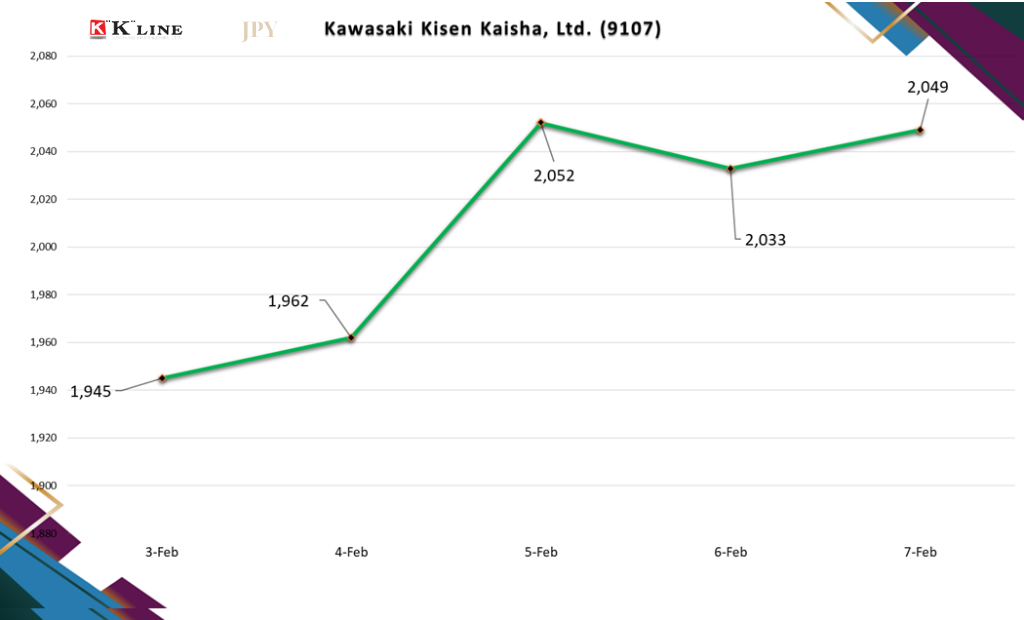

- Kawasaki Kisen Kaisha, Ltd. (9107)

Kawasaki Kisen, also known as K-Line, saw steady growth, climbing from ¥ 1,945 to ¥ 2,049. The Japanese shipping giant’s exposure to both container and bulk shipping helps diversify its revenue streams. Recent increases in global freight rates, driven by supply chain issues and rerouted vessels, may be supporting its stock.

Even so, the company remains vulnerable to shifts in global demand, particularly in China and Europe, which could affect longer-term pricing.

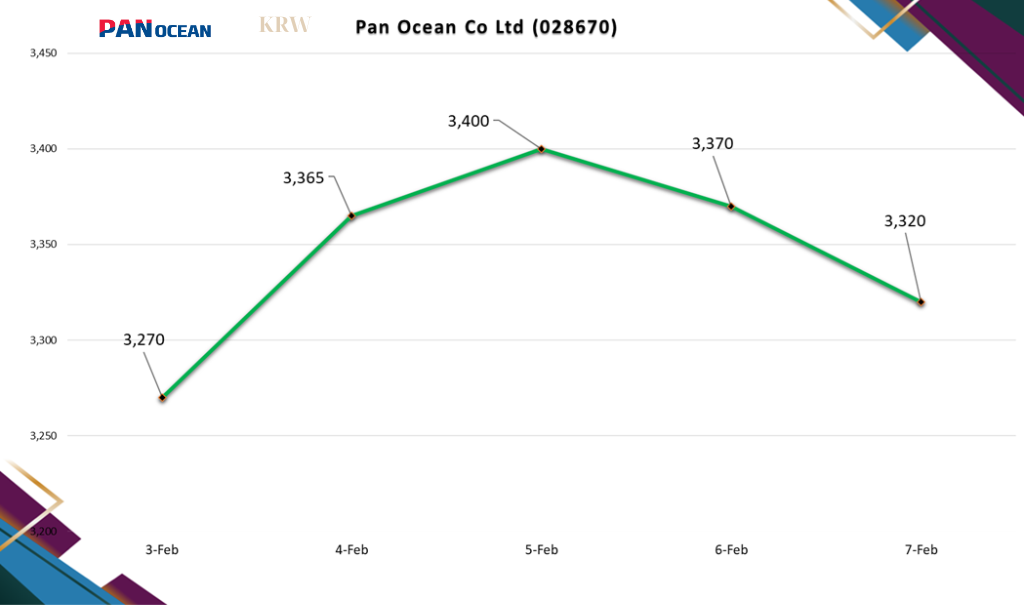

- Pan Ocean Co Ltd (028670)

Pan Ocean’s stock experienced modest fluctuations, reaching KRW 3,400 before settling at KRW 3,320. As a key player in bulk shipping, the company is influenced by commodity demand, particularly from China and South Korea. With global economic uncertainty affecting industrial production, Pan Ocean’s future outlook will depend on whether raw material demand remains strong.

Yet, geopolitical risks, such as tensions in the Red Sea and fuel price fluctuations, could impact operating costs.

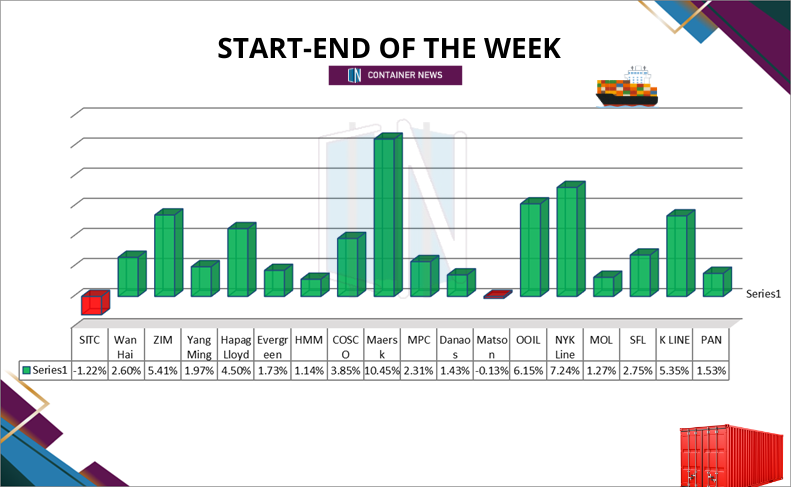

The week’s stock performance largely reflected positive momentum, with most companies recording gains. Maersk led the pack with a 10.45% surge, signaling strong investor confidence amid ongoing global shipping disruptions. NYK Line and OOIL also posted impressive growth, benefiting from elevated freight rates and shifting trade patterns.

While SITC saw a slight 1.22% dip, the broader trend suggests that companies with extensive global networks and diversified operations are well-positioned to capitalize on current market conditions. As geopolitical tensions and economic uncertainties persist, adaptability remains crucial for sustained success in the shipping industry.