Danish maritime data analysis firm Sea-Intelligence said that freight rates are primarily determined by changes in vessel utilisation, which in turn means that when shipping lines deploy “too much” capacity, they effectively contribute to falling rates, and in times of endemic over-supply, such as those we are currently heading into, over-capacity becomes “fuel” for a price war.

“While there is to objective measure for “too much” capacity, a starting point would be to compare how capacity growth lines up with demand growth,” noted Sea-Intelligence.

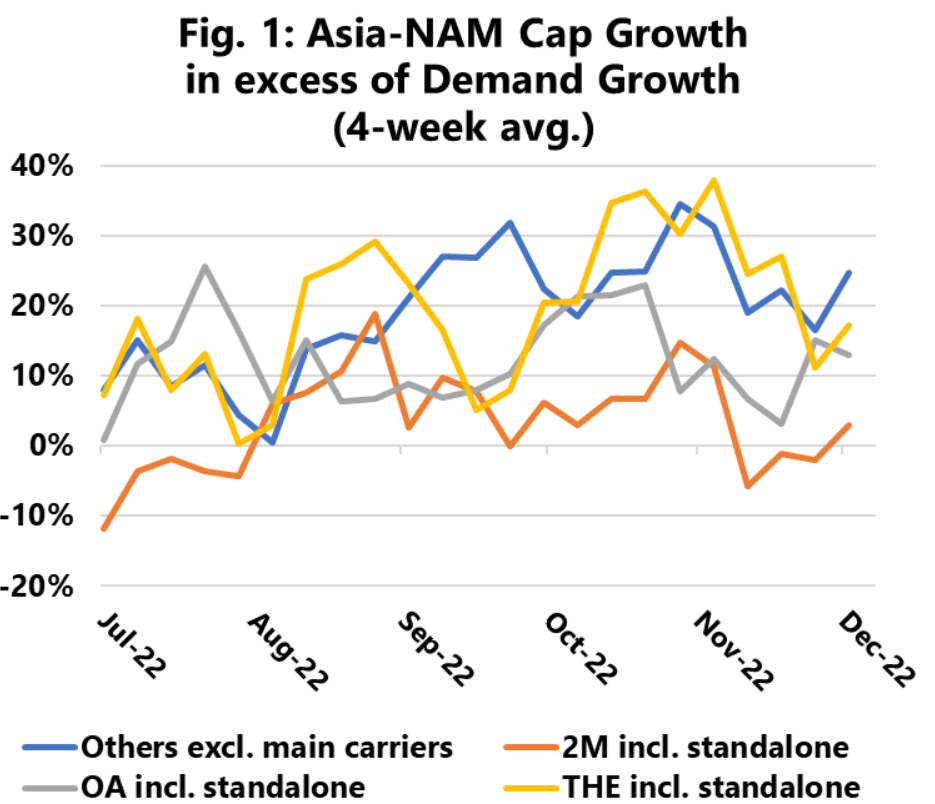

In the figure, the Danish analysts have calculated and presented the difference in percentage points between demand growth and capacity growth, for the three container carrier alliances (including standalone services operated by the alliance carriers) and non-alliance carriers.

Alan Murphy, CEO of Sea-Intelligence, explains that a positive number means that a carrier alliance has seen its capacity grow more (or contract less) than the market demand, and as such how much they have “contributed” to the structural overcapacity in the market.

According to the report, the 2M alliance has for part of the time contributed slightly to overcapacity, and for other periods has not contributed at all or has been reducing capacity more than the demand decline in the market.

Sea-Intelligence’s analysis also shows that MSC contributes more to capacity reductions than its 2M partner Maersk.

On the other hand, we see that THE Alliance carriers, as well as the non-alliance carriers, have contributed the most to the structural overcapacity in the Transpacific market.

“This does not necessarily mean that THE Alliance carriers, Maersk, and the non-alliance carriers are at the forefront of driving freight rates down directly,” pointed out Murphy, who, however, noted that it means that these carriers are more “responsible” for the overcapacity in the market than their competitors.

Sea-Intelligence analysts added that a carrier might choose to not reduce capacity if they can fill their own vessels, but the net effect of this is structural overcapacity in the market, which does in turn fuel a price war.