A prominent climate researcher has said the World Shipping Council (WSC)’s market-based measure (MBM) proposals are unworkable because they incentivise biofuel use over the more likely ammonia and methanol green hydrogen-derived fuels.

WSC submitted its proposals for the March Marine Environment Protection Committee (MEPC)’s March meeting, arguing that the high cost of green fuels will be prohibitive for poorer states.

“The magnitude of the GHG price imposed can be expected to cause significant economic impacts in the global economy and even greater economic impacts in the many countries that are especially vulnerable to higher transport costs,” says the WSC proposal.

According to the WSC, the price gap between conventional and green fuels is around US$1,400/tonne if conventional fuel is priced at US$600/tonne.

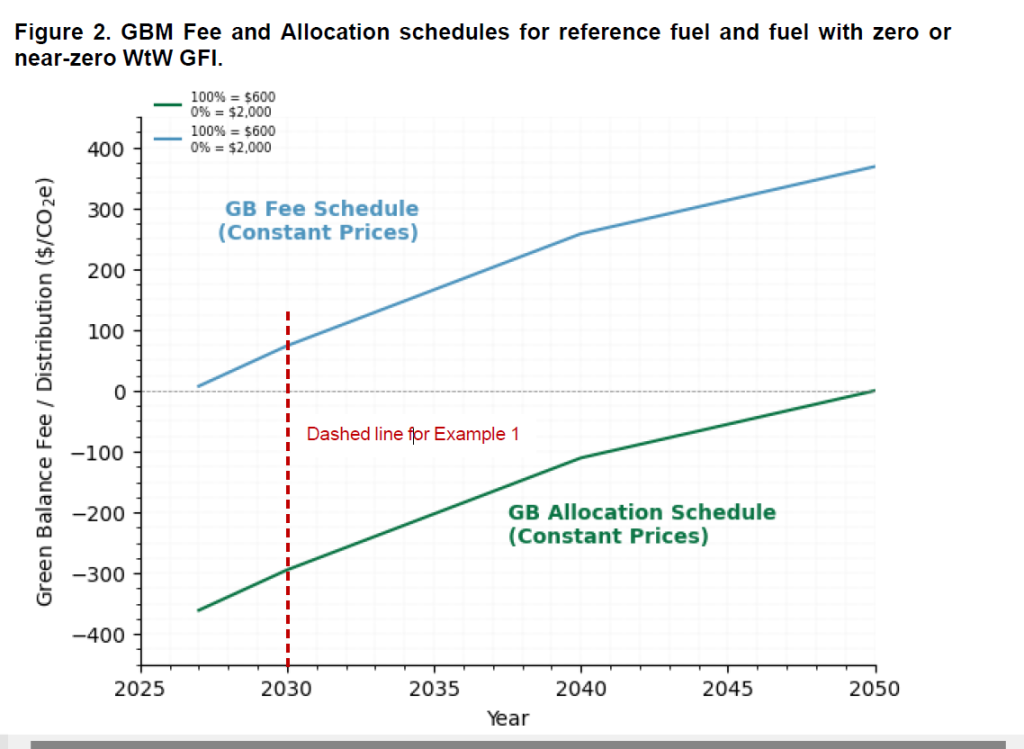

To bridge that gap, WSC proposes a Green Balance Mechanism (GBM) which includes a GHG Fuel Intensity (GFI) threshold. Fuels will then be assessed against the reference GFI, which is a measure derived from the well to wake calculation for fossil fuels. The GBM is then calculated between the reference and GFI of the green fuel.

However, the researcher, who preferred to remain anonymous, said that hydrogen derived fuels were likely to form the major basis of green fuels in the medium term while this proposal from WSC incentivises the use of biofuels.

“By creating a reward system that incentivises biofuels, which we know there is not enough of, we will create a system where the hydrogen based green fuels are not developed and that will lead to lost decades in the green transition,” explained the researcher.

Effectively, he added the biofuels will get more expensive and fuels like ammonia will become cheaper, but the GBM will mean “By 2035 we will get to a situation where we need to retrofit 50,000 ships to GHG climate targets, it’s simply unworkable.”

The linear nature of the GBM means that variations in cost of green fuels is not recognised and the requirement to shift from fossil fuels to low carbon equivalent fuels will not be driven by the regulation.

However, the WSC proposal claims: “Ships that meet or perform better than the prescribed Green Balance GFI threshold will qualify for Green Balance funds. Furthermore, Green Balance funds would be allocated based on energy consumed with a GHG-intensity value measured in grams CO2e per megajoule (gCO2e/MJ) that performs equal to or better than the Green Balance GFI threshold.”

MEPC 81 is scheduled to take place from 18-22 March at the IMO’s London headquarters. MEPC will discuss the implementation of MBMs for the maritime industry following the first such mechanism introduced in January by the European Union which has seen carriers now imposing caried charges on shippers for EU Emissions Trading System costs.

One of the major contentions of an MBM is who will hold the funds and how these funds will be used, the GBM will mean that funds are returned to operators of clean ships and this will redistribute GBM funds immediately so that there is no central funds held for any length of time.