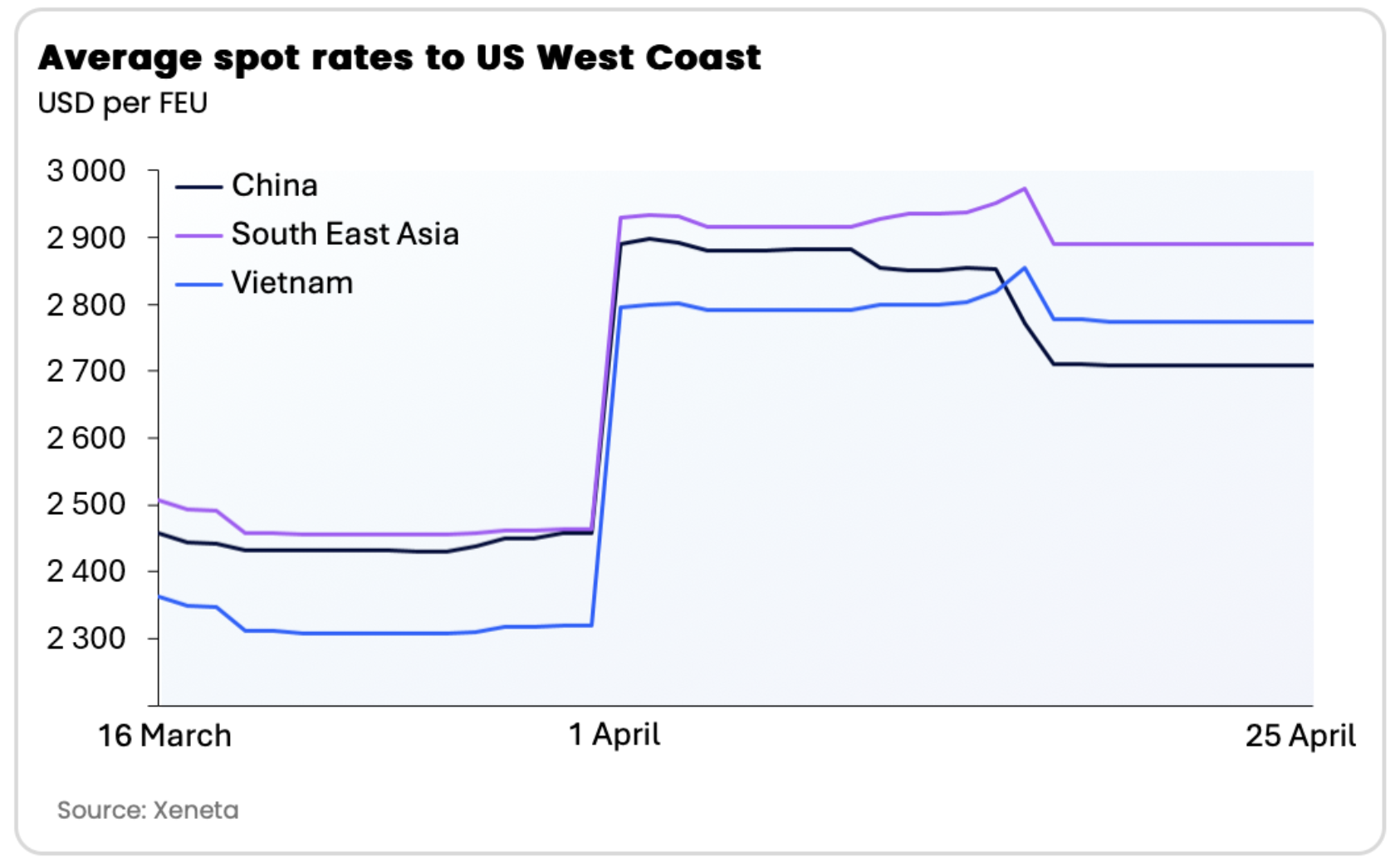

Ocean and air freight rate benchmarking and market intelligence platform Xeneta provided the latest data on average spot rates on trades from China, Vietnam, and Southeast Asia to the US West Coast.

Xeneta includes the average spot rates on the major Far East fronthaul trades.

Data highlights:

China and Vietnam comparison

- Average spot rates into US West Coast on 16 March 2025

- From China: US$2,457 per FEU (40ft container)

- From Vietnam: US$2,362 per FEU

- Average spot rates into US West Coast on 25 April 2025

- From China: US$2,709 per FEU

- From Vietnam: US$2,774 per FEU

- Importing into the US West Coast from China was more expensive than importing from Vietnam on 16 March. On 25 April, Vietnam has become the more expensive of the two trades.

Data highlight 2: China and South East Asia comparison

- Average spot rates from China to US West Coast on 31 March

- From China: US$2,457 per FEU

- From South East Asia: US$2,464 per FEU

- Average spot rates from China to US West Coast on 25 April

- From China: US$2,709 per FEU

- From South East Asia: US$2,890 per FEU

- Spread in rates between China and South East Asia trades into US West Coast has widened from US$7 per FEU on 31 March to US$181 on 25 April (with South East Asia the more expensive).

Xeneta analyst insight – record capacity from Far East to North Europe

Peter Sand, Xeneta Chief Analyst, commented: “We are now seeing the shifting global trade patterns caused by the tariffs play out in ocean freight rates.

“Falling demand out of China has coincided with shippers rushing imports out of Vietnam, which is subject to a 90-day pause on reciprocal tariffs. Seeing the relationship between these two trades turn its head is an early indication of the potential for tariffs to shift global trade on its axis.

“There is a similar story when comparing freight rates into the US West Coast from China and the South East Asia region. As shippers stopped or slowed exports from China due to the tariffs, they have accelerated exports from South East Asia countries, which has caused the spread in freight rates on these trades to widen.

“On 31 March, just before the ‘Liberation Day’ announcement, it cost almost exactly the same to import into the US from China or South East Asia. The spread in spot rates is now approaching US$200 per container, with South East Asia the more expensive, and that is a direct consequence of shippers reacting to the tariff threat.”