ZIM Integrated Shipping Services Ltd. has completed remarkable financial rises during the third quarter of the year.

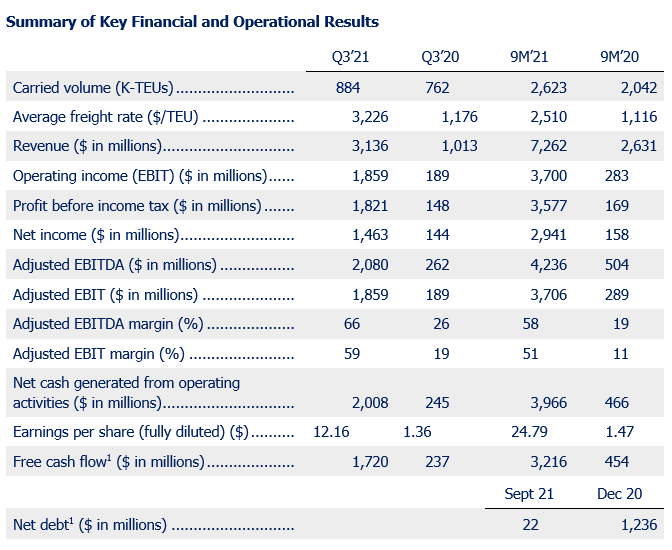

The company’s net income reached US$1.46 billion, which reflects an astronomical year-on-year rise of 913%. During the same period, the Israeli shipping line has also reported an operating income (EBIT) of US$1.86 billion, representing a significant surge of 884% compared to last year’s Q3, while its adjusted Earnings Before Interest, Tax, Depreciation, and Amortisation (EBITDA) stood at US$2.08 billion, which translates to a year-on-year growth of 693%.

Meanwhile, the margins of adjusted EBITDA and adjusted EBIT for the third quarter of 2021 were 66% and 59%, respectively.

Furthermore, ZIM saw its total revenues to increase by 210% year-on-year, reaching US$3.14 billion, mainly driven by an increase in revenues from containerised cargo, reflecting the elevated freight rates as well as the volumes handled.

Moreover, the carrier’s operating margin for the third quarter stood at 59% and was elevated by 40 percentage points over the same period of 2020, while net cash generated from operating activities surpassed US$2 billion.

At the same time, ZIM carried 884,000TEU during the third quarter, representing a rise of 16% year-on-year, with the average freight rate per TEU being US$3,226.

During the third quarter, the Haifa-based carrier has also purchased eight second-hand vessels that were built between 2007 and 2010 in a number of separate transactions. The vessels purchased include five 4,250TEU vessels, one 2,553TEU vessel and two 1,100TEU vessels for a total consideration of approximately US$355 million.

Eli Glickman, President and CEO of ZIM, stated, “Complementing our success securing our operating fleet and equipment to best serve our customers, we have distributed a US$2 per share special dividend in September 2021 and we are now transitioning to paying quarterly dividends to provide shareholders with an immediate and more frequent return.”

He went on to say, “Accordingly, we will be paying in December 2021 a US$2.50 per share interim dividend for the third quarter, representing approximately 20% of quarterly net income.”

Taking into account the aforementioned statistics, ZIM has increased its full-year guidance and expects to generate in 2021 an adjusted EBITDA of between US$6.2 billion and US$6.4 billion as well as an adjusted EBIT of between US$5.4 billion to US$5.6 billion.

“Going forward, our unrelenting focus remains on further executing our global-niche strategy to achieve superior long-term profitability, while maintaining significant fleet flexibility, promoting our Environmental, Social, and Governance (ESG) values as we provide a best-in-class customer experience and taking advantage of compelling growth opportunities,” commented Glickman.